Startups that are successful in securing essential funding tend to demonstrate the same behaviors. One of the most important elements is knowing which investors to target and how to approach them. A lot of time (and therefore money) can be wasted by getting this wrong.

The key takeaway is that there’s no “one size fits all.” You need to tailor each offer depending on who you’re speaking to. If you decide,for example, that you you're going to try and convince your Uncle Joe that he should invest $100,000 in your business, you might not need to invest too much in creating an interesting offer, because maybe Uncle Joe just loves you and he's going to give you the money anyway.

On the other hand, focusing on corporate VC because you think that can get you access to channels and customers that you couldn't get in some other way, means creating an offer that appeals to the corporate VC's interest. That may not include equity. It may be they don't care about equity because they don't know even where to put it on their balance sheet.

If you lean towards a seed fund, and if it's a real VC (i.e., an "institutional investor"), keep in mind they're managing other people's money. You will have to be prepared to go through some kind of formal diligence process and give them the kind of security that they want, in which case it would likely be at least a Series Seed offer.

Thus, knowing the type of security is important. But you also have to think about the valuation. I mean, if you go to somebody and you're pre-revenue, and you say, "Hey, we're looking for a million dollars and we're going to give up 5% of the company," my guess is that not many people are going to find that very interesting. Who knows?You could be a great salesperson. If you've got some real traction and a product/market fit, the offer might not be so ridiculous...it's subject the laws of supply and demand.

The compelling offer

Once you’ve identified the type of security and considered the valuation, you need a compelling offer. Not only do you have to create the kind of security that your investor wants, but you also have to structure it in a way that the valuation is reasonable. But how?

Should you take the lead in creating the offer and presenting it? "Hey here's the offer – take it or leave it?" Or are you supposed to bepassive and say, "Well, I don't know – you're the expert, why don't you give me an offer?"

In my experience, you need to be respectful of the investor and put yourself in their shoes. If it's an investor that's in the business of negotiating and valuing companies, then obviously they want to have some discretion and they will likely want to take the lead in making that first definitive offer.If it's somebody that really isn't in the business (friends, family, and fools), then you’d be putting a lot of pressure on them to come up with an offer and it might not something they are comfortable doing.

The harder you make it for a prospective investor to get to "yes", the more likely you won’t get there. I find that a lot of entrepreneurs have a tough time coming up with any kind of a compelling offer that's actionable within a reasonable time period. For this reason, you will probably need a lawyer – a securities lawyer – who can help you make sure that your offer makes sense before you present it.

Getting it wrong

I’ve kicked the tires on several thousand startup and early stage venture finance opportunities. I've been asked to be part of the investor group in many different ventures. I'm a curious, open-minded person and I'd like to think I'm easy to talk to, but I'll give you an example of something that for me, as an angel investor, is not compelling.

It's when an entrepreneur says: "Hey, do you want to invest in my deal?" That's not good enough.

I say, "Well, what is the deal? Do you have a term sheet?" If the answer is "No", I'd typically reply “So how do I even know what your deal is?”

An entrepreneur once came to visit me where I live in Basel, Switzerland. He took a train, a three-hour train ride, to meet me personally to tell me his story. I listened carefully to his story over a 45 minute lunch, before he asked me, "So, will you be one of my investors?" I asked, "Well, what is the offer? What's the deal?"

And he answered: “Well, you're the professional investor; you shouldmake me the offer.”

I said, "Well, really – I mean, you want me to do the homework? Is there anything we can look at? Do you have a proposed term sheet?Do you have a lawyer?" He said "no, no, I was waiting until I found an investor first." I asked him where he is organized, and he said that he incorporated in one of the European offshore tax havens. I explained to him that based on what he's told me so far, there's no way I would say "yes" at this point. I would need a lot more details.

Of course, if I was truly in love with the story/opportunity, I could do the homework to come up with the right organizational structure and offer. But that's asking a lot from an angel investor. From my perspective, if an entrepreneur is too lazy or too unsophisticated to get his house in order and create a compelling offer before pitching to investors, what does that say about his or her ability to turn the idea into reality and then scale the business?

Ask yourself: is your offer real, or are you just out there fishing? Because a fishing expedition when you have not yet put your house in order, and you don't have an offer that's both compelling and actionable is likely to be a bad day of fishing. It could go on for months, or even years. Sadly, I've seen this entrepreneurial story play out more times than I can remember.

Getting it right

In my experience, the best approach is to do your homework and create an offer that resembles what similar companies at a similar stage in your target geographic market are doing. Then you approach the people who finance those kinds of ventures and present them with something that's both compelling and actionable.

After the lunch or the pitch or whatever, if somebody says they're interested in your company, what have you got to give them? Can you back it up with a term sheet or with a subscription agreement? Do you have a due diligence locker that people can look at to make sure you have your house in order?

Over the past couple years, I've made more than ten angel investments, in multiple jurisdictions (USA, Europe and Australia). In each case not only was the "story" and the team ambitious, the company was well-organized, had a due diligence locker and already had all (or at least most) of the appropriate agreements in place. And at that point, all I had to do was get comfortable with my due diligence investigation (including maybe tweaking a few things), sign the subscription agreement, and wire the money. Simple.

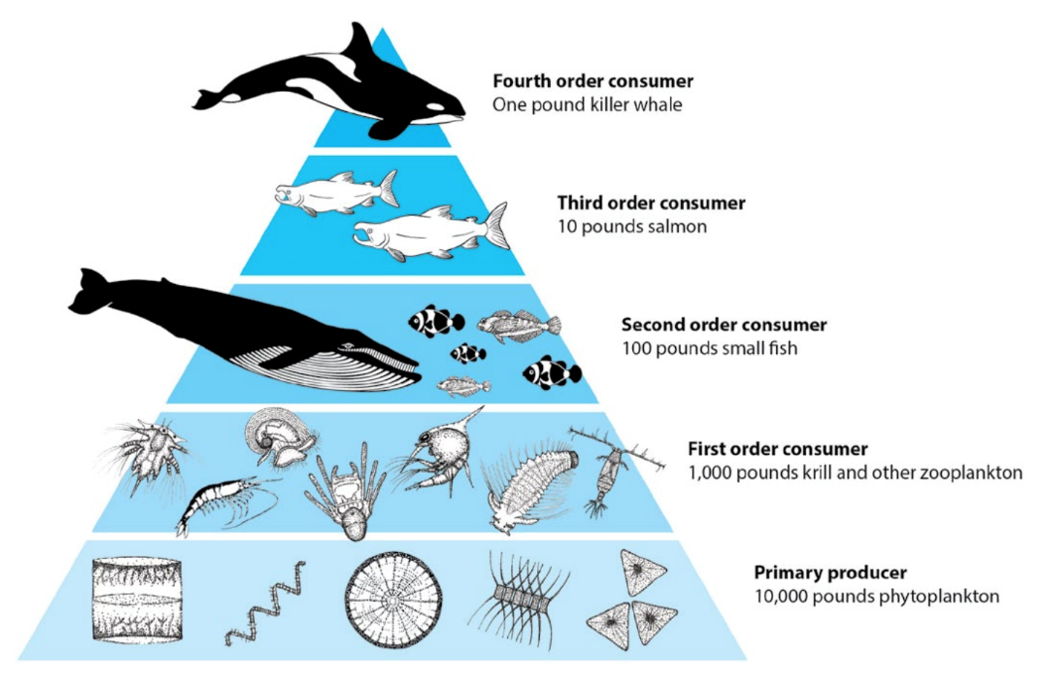

That's the way most entrepreneurs achieve success raising pre-seedfunding from angel investors. Of course, there are lots of other sources of venture finance besides angels or VCs. You might be able to tap into sources of venture financing (including non-dilutive) from governments, corporates, banks and other types of specialized lenders such as venture leasing or revenue backed notes. As the the chart above illustrates there are a lot of different "fish in the sea". Although different "species" feed on different types of "food", there is something common among all of them. First, they need to believe in the story/vision/team. Second, they need to see a compelling offer that is actionable. Third, they need to be convinced that the opportunity is not a "phony lure". In other words, if they invest time to engage in due diligence, there will be alignment between what you say and the real state of affairs.

In summary, creating a compelling offer is really about empathy. It's about putting yourself in somebody else's shoes and saying, “How can I make it easy for them to say yes?”

Are you currently raising money for your startup?

But... are you, your team and startup ready to take it?

If you are a startup founder and would like to take the Investor Readiness Test Click on the button below.