Welcome to this comprehensive exploration of the fundraising landscape for startups in 2024. We will be drawing insights from the latest episode of our Fundraising Podcast. In this season opener, we will delve into the trends, challenges, and strategies for startup founders and funders. We aim to provide you with actionable insights and strategies that can lead to your success in securing and/or deploying capital for your startup or emerging growth company, in an increasingly complex global environment.

Understanding the 2024 Fundraising Climate

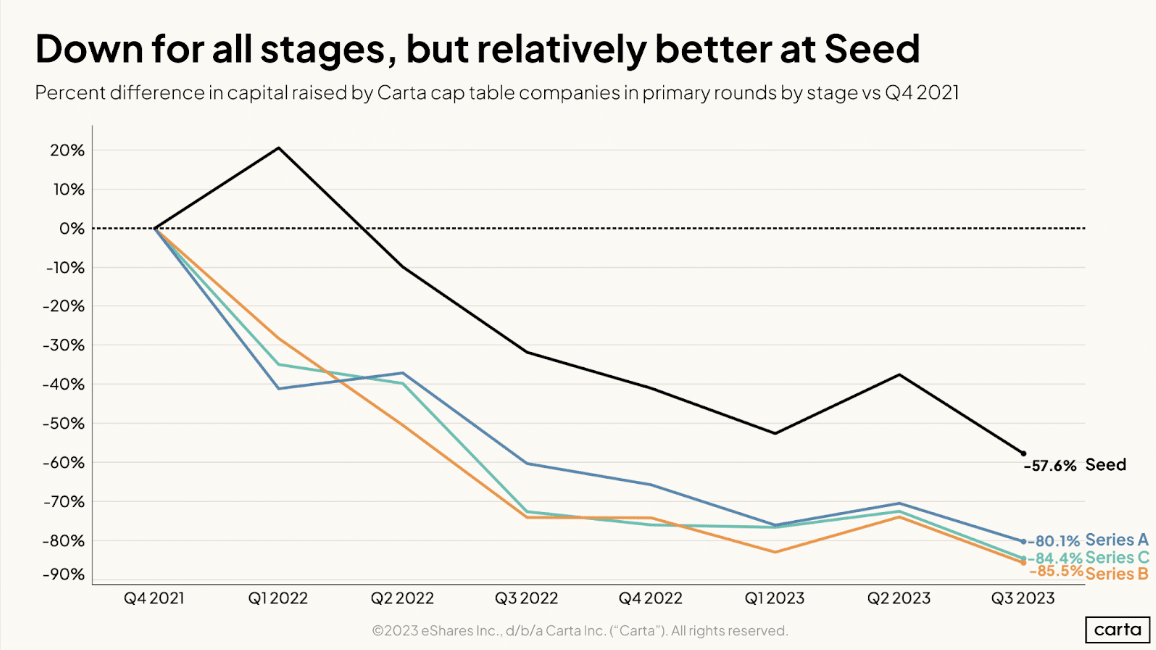

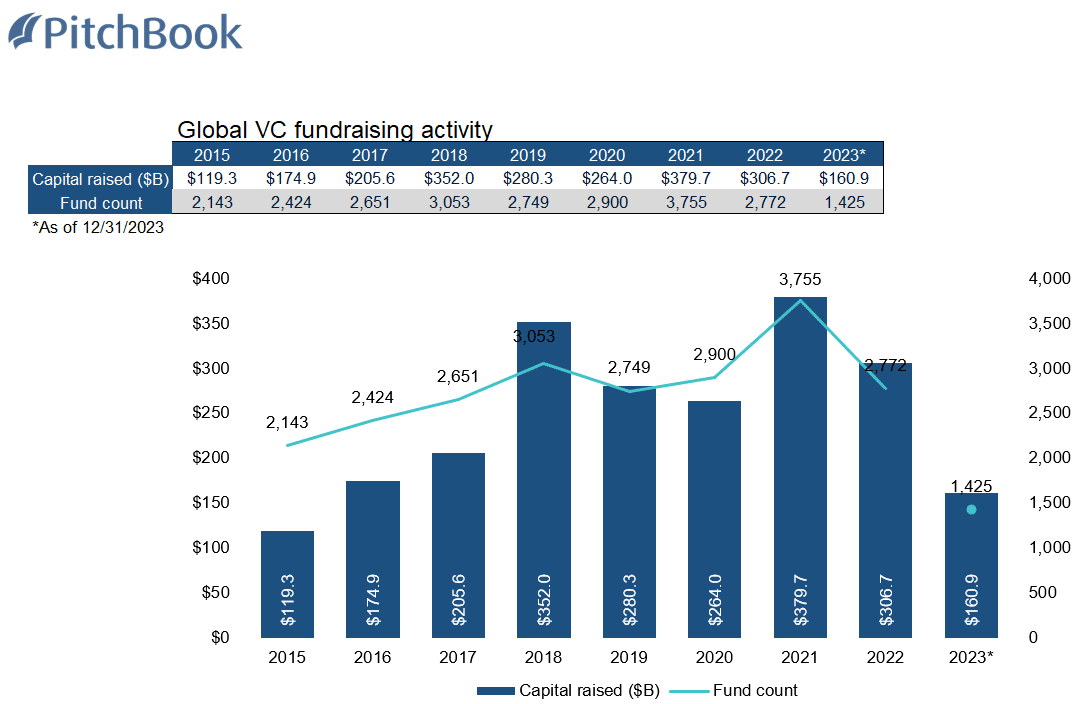

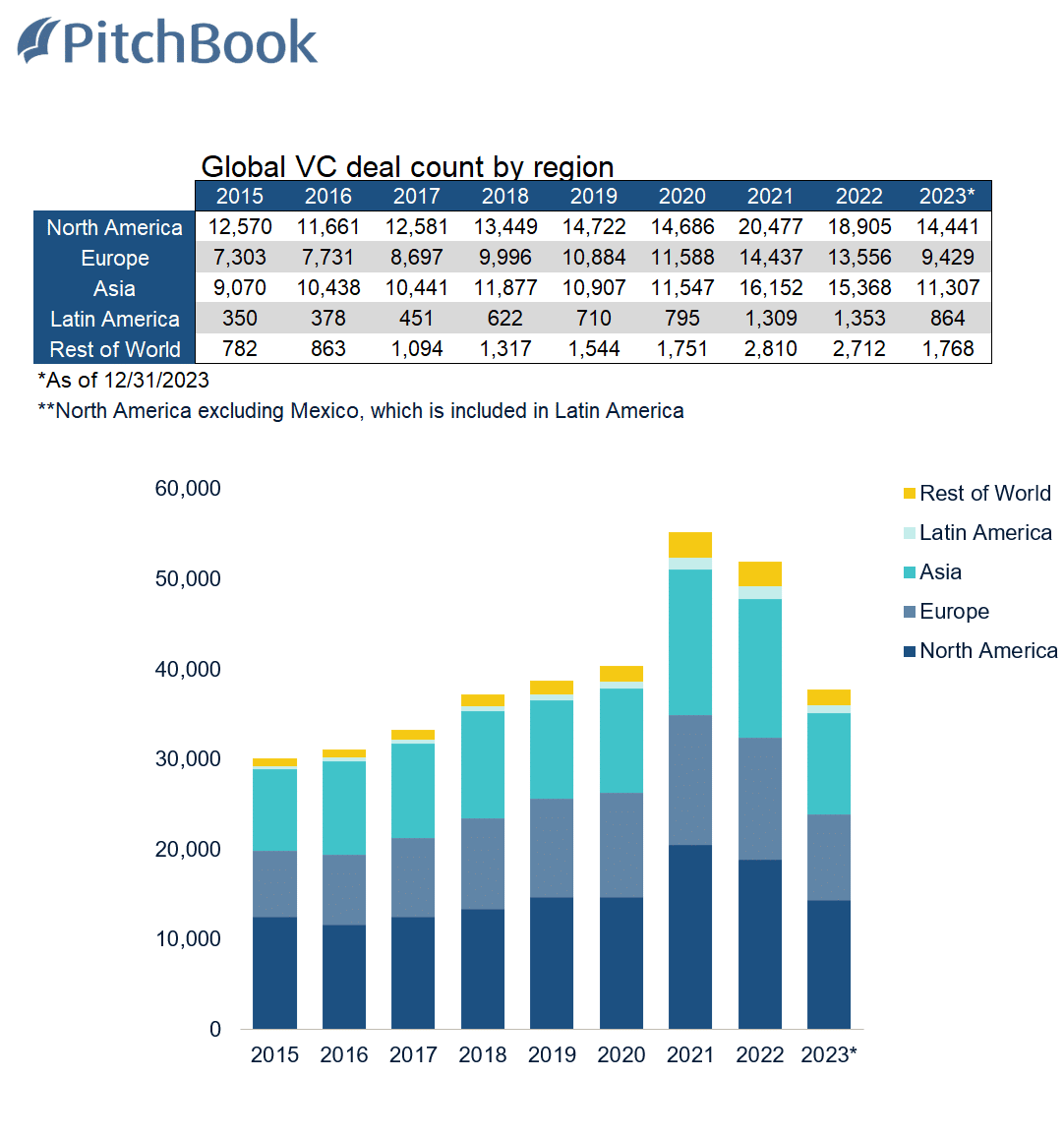

The fundraising scene in 2024 is marked by cautious optimism amidst a backdrop of declining VC deal activity and a more selective investment climate. Data from credible sources like PitchBook and Carta reveals a global downturn in VC deal activity and dry powder (unallocated capital) in 2023, raising concerns about whether the bottom of this trend has been reached.

However, this doesn't signal a dead end but rather a shift towards more strategic fundraising efforts. What does this mean for you? Adaptation and clarity in your fundraising strategy is more crucial than ever.

Key Trends and Data Insights:

- Global Deal Activity: After peaking in 2021, global VC deal activity has seen a significant reduction. The question remains whether we've hit the bottom of this downward trend.

- Dry Powder: Despite a decrease in new VC capital inflows in 2023, substantial capital from previous years remains to be deployed. This suggests that while new VC funding is slowing, there's still considerable capital in the system.

- Regional Dynamics: Asia is emerging as a powerhouse, with more capital being invested in VC funds there compared to North America and significantly more than Europe. This shift indicates Asia's growing importance in the global venture capital landscape.

Strategies for Startups and Emerging Growth Companies in 2024

Given the current fundraising climate, startups and emerging growth companies need to adapt their strategies to secure capital successfully. Here are actionable insights and recommendations:

Understand the Landscape

Startups should have a clear grasp of the fundraising environment, including trends in deal activity, investor preferences, and regional dynamics. Recognizing the challenges of raising capital in a downturn can help in setting realistic expectations and strategies.

Storytelling and Pitching

Having the ability to tell a compelling story has become increasingly critical nowadays. A well-crafted story is what makes a pitch successful. When presenting your startup to potential investors, your story should not only highlight your product's innovation but also the impact it aims to create. It is essential to keep in mind that investors don't just invest in ideas; they invest in people. Therefore, your narrative should be engaging, relatable, and memorable.

Actionable Tip: Check Pitch Academy Courses to craft a story that captures the essence of your startup and resonates with your potential investors.

Seeking Capital Across Borders

As Asia emerges as a significant source of capital, startups in Europe should explore opportunities beyond their geographic boundaries for funding. The worldwide venture capital industry implies that chances for funding may be more abundant in regions experiencing growth in deal activity.

Platforms like CRIISP Capital HQ offer networking opportunities with investors across the globe, breaking down geographical barriers and opening up new avenues for capital.

Focus on Efficiency and Milestones

Show, Don't Just Tell

In a highly competitive fundraising environment, it is crucial to demonstrate your progress and reach significant milestones. This is because investors are more inclined to support startups that have a clear plan for growth and profitability. This is especially important when there is a shortage of capital.

Your Next Steps

With these expert insights and strategies, you are better equipped to take your fundraising efforts to the next level and confidently charge ahead in 2024! Take the next step...

Watch the Full Episode: Dive deeper into fundraising by watching the full episode of the Fundraising Podcast. Gain expert insights, hear from founders, and learn fundraising nuances relevant to 2024 and beyond.

The fundraising landscape for startup and emerging growth companies in 2024 is full of challenges and opportunities. Founders and funders can successfully navigate these turbulent times by understanding the current trends, refining their pitch, and exploring all avenues for capital. As we move forward, fundraising success will depend on flexibility, resilience, and a clear vision.

Join us on the Fundraising Podcast to explore raising capital in today's private capital markets.