The Fundraising Roadmap for Founders

Many founders are looking for the next funding round that could represent the critical growth or – in some cases – the basic survival of their startup. They know they need money and sometimes they know where they might get it, but the process of actually getting it is more detailed than many founders appreciate.

There is, naturally, a huge amount of competition for the available funds. Who gets it? The startup with the best product or the highest number of prospective customers? The startup with the best team and the most experience? In an ideal world, maybe . . .

The truth is that the people who get the funding are the ones who understand the correct process for identifying the kind of funding required, the correct sources, the best way to approach these sources and how to finalize the deal. Those are the founders who get the funding they need.

There’s an essential roadmap that founders have to follow if they want to get their hands on critical funding for their business. Understanding it – and following it – is not only the right way. It’s the only way.

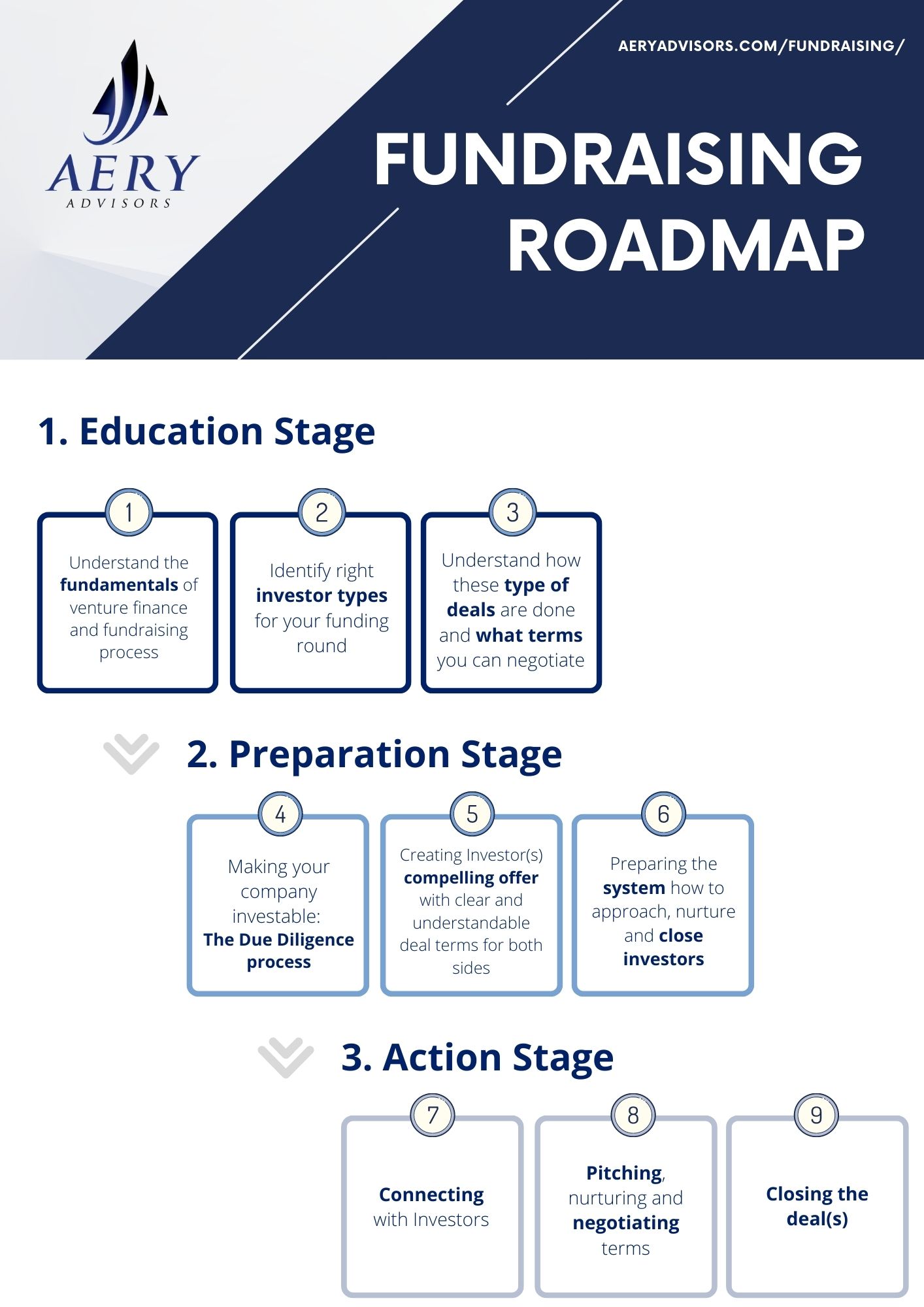

1. The Education Stage

Understand the fundamentals of venture finance and fundraising process

It’s not enough to need money. You need to know what kind of money is right for your business and what kind of money is actually available. A crash course in the fundamentals of venture finance is necessary: how to raise money. Who is offering money? Is all money equal? Is some money better than others for your business? Does some money come with strings attached?

Identify right investor types for your funding round

Next in the education stage is understanding the range of investors out there. It’s not only angels. There are VC firms, local authorities, national governments, enterprise schemes and many more. Which is right for you? Which invests in your sector, location or stage of development?

Understand how these type of deals are done and what terms you can negotiate

Next, you need to know what kind of deals exist and what they mean for the future of your business. No money is ever free! There are always conditions depending on the kind of deal. Can you negotiate? What can you negotiate? There is very little possibility of securing funding without having a solid foundation in all of these educational basics.

Learn more about the education stage in our podcast episode

To enable you and our growing community of users to dive deeper into the venture finance ecosystem waters, in this podcast episode Brad Furber and Yomi Bashorun review the key pillars of the Fundraising Roadmap. In the first episode you will learn more about the Educational stage of the fundraising journey.

Many founders are so busy doing other things that they skip this important first stage of the journey, which unfortunately can lead to making foundational mistakes which can be very difficult and costly to correct downstream.

Recommended Resources for educational stage

The short two-hour Fundraising Masterclass

goes into more depth about the four key principles of raising money.

2. The Preparation Stage

Making your company investible: The Due Diligence process

Once you have a clearer idea of the type of funding you can realistically get and from where, it’s important to make sure that your business is actually investor-ready. Any investor is going to immediately ask a number of detailed questions about the condition of your startup. These might include the legal and financial health of the business. Have you got all of the necessary documentation to show your investor? Have you done all of the due diligence?

Due diligence for startup fundraising is the process that allows investors to assess the risks and potential returns of investing in the startup.

The due diligence process typically includes reviewing the following aspects of the startup:

- Financial statements.

Investors will review the startup's financial statements, including balance sheets, income statements, and cash flow statements, to get a sense of the company's financial health and performance. - Business plan.

Investors will want to understand the startup's business model, target market, and growth strategy. - Intellectual property.

Investors will want to ensure that the startup has the necessary intellectual property rights and that any technology or proprietary information is protected. - Management team.

Investors will want to evaluate the experience and capabilities of the startup's management team. - Customer base.

Investors will want to understand the size and demographics of the startup's customer base, as well as their level of satisfaction. - Market size and competition.

Investors will want to understand the size of the market the startup is targeting and how it compares to competitors. - Legal and regulatory issues.

Investors will want to ensure that the startup is in compliance with all relevant laws and regulations.

By conducting due diligence, investors can make informed decisions about whether to invest in a startup and at what valuation. Your goal as a startup founder to make it as clear and as easy as possible for investors to access that information when it will be requested.

Creating Investor(s) compelling offer with clear and understandable deal terms for both sides

Often, an investor will ask for your offer. This is more than, “You give me money and I’ll grow my business.” The investor will need to see a detailed and compelling offer explaining the advantages for them – not only for you. If your offer is not both clear and compelling, another startup may take the funding because they explained their case better. They better understood how investors think.

A compelling offer for investors should consist of several key elements that clearly articulate the value proposition of the startup and its potential for success.

- A clear problem and solution.

Investors will want to understand the problem that the startup is solving and how its product or service is uniquely positioned to address it. - A well-defined target market.

Investors will want to understand the size and demographics of the market the startup is targeting, as well as the potential for growth. - Strong management team.

Investors will want to see that the startup has a competent and experienced management team with a track record of success. - Solid financial projections.

Investors will want to see realistic and well-supported financial projections that demonstrate the potential for strong returns on their investment. - Differentiation from competitors.

Investors will want to understand how the startup's product or service is different from what is already available in the market, and how it has a competitive advantage. - Potential for scalability.

Investors will want to see evidence that the startup has the potential to grow and scale its business over time. - Terms and conditions.

What they will get in exchange of investment? What type of investment you are offering (equity, debt, etc). What are other terms you want to include? If it is equity what type of shares you are offering? What is your current (pre-money) valuation and on what it is based? How many investors participate in the round? Do you have a leading investor for the round?

By including these elements in the offer, the startup can effectively communicate its value proposition and convince investors that it is a worthwhile investment opportunity.

A term sheet

A term sheet is a document that outlines the terms and conditions of an investment in a startup. It is typically used to negotiate the terms of an investment with potential investors and serves as the basis for the final investment agreement.

The main parts of a term sheet include:

- Investment amount.

The amount of capital that the investor will provide to the startup and what investor will get in exchange. - Valuation.

The valuation of the startup, which determines the percentage of ownership the investor will receive in exchange for their investment. - Ownership structure.

The ownership structure of the startup, including the number of shares outstanding and the percentage of ownership held by the founders and investors. - Dilution.

The extent to which the value of the founders' and existing investors' ownership is diluted by the new investment. - Liquidation preference.

The order in which investors will receive their investment back in the event of a sale or liquidation of the company. - Board of directors.

The composition and powers of the board of directors, which is responsible for the overall direction and management of the company. - Protective provisions.

Provisions that protect the interests of the investors, such as the right to appoint a certain number of directors to the board or to approve certain business decisions. - Closing conditions.

The conditions that must be met before the investment can be finalized, such as the completion of due diligence and the execution of legal documents.

Term sheets are an important part of the startup fundraising process and can have a significant impact on the future of the company. It is important for founders to carefully consider the terms outlined in the term sheet and seek legal advice as needed. This is the part where venture finance advisor can deliver a lot of value.

Preparing the system how to approach, nurture and close investors

It’s very unlikely the first investor you approach will say yes. This means you also need a solid system in place to approach multiple investors and track the stage of your offers. How do you respond to signs of interest? What extra information can you offer? What happens if an investor asks for more but then doesn’t respond? And how can you successfully close a deal once all sides agree?

The usual startup fundraising toolkit consists of the following:

- A pitch deck.

A pitch deck is a presentation that summarizes the startup's business plan and financial projections, and is typically used to pitch the company to potential investors. - A financial model.

A financial model is a tool used to project the startup's financial performance over a given period of time. It helps investors understand the potential return on their investment and the risks involved. - A term sheet.

A term sheet is a document that outlines the terms and conditions of an investment, including the amount of capital to be invested, the valuation of the startup, and the ownership structure. - Legal documents.

Legal documents, such as articles of incorporation, bylaws, and shareholder agreements, provide a framework for the startup's legal and governance structure. - A customer list.

A customer list helps investors understand the startup's customer base and the potential for growth. - Marketing materials.

Marketing materials, such as brochures, website content, and product demos, help investors understand the startup's value proposition and target market.

Having these tools in place can help the startup effectively communicate its value proposition and secure funding from investors.

Learn more about the preparation stage in our podcast episode

In this podcast episode Brad Furber and Yomi Bashorun review the investor due diligence process, creating a compelling offer for investors, and preparing the system for closing investors.

Recommended Resources for preparation stage

Access the FREE Global Fundraising Directory:

- Expand your Investors Network

- Additional external resources to 80.000+ capital sources

- Constant database update

- Constant external resources list update

- Tack Investors template

- All is FREE of charge

This short guide is designed to help startup founders map out a strategy and a process to identify, target, and close funding from their ideal sources of capital faster and smarter.

It's time to create your winning pitch for prospective investors. We have partnered with the Best3Minutes to make it simple for you to master the skill of pitching.

Your pitch coach David Beckett has coached over 1500 Startups – from companies looking for pre-seed funding, through to scale-ups raising €50Million+.

Get your customized DREAM LIST of the TOP 100 investors ideal for your startup

based on your industry, region, and stage of development.

Your actionable Investor Dream List includes: investor contact details, number of investments, Investor Type, Industry, Last closed fund size and date, assets under management, and much more.

Aery Advisors provides a range of services to startups at various stages and sizes, helping founders to understand the whole funding landscape and how to secure that all-important capital.

If you are the smart startup founder or business owner and you need an expert help in raising funds, look no further.

3. The Action Stage

Connecting with Investors

Once you’re in communication with interested target investors, you need to act decisively and professionally. How do you speak to them in the language they understand? What kind of materials will you need to prepare for this stage and have ready for potential meetings or presentations? When the time comes, you need to act!

Here are 11 tips, that can help you in the connection with investors process:

- Define your target investors.

Identify the type of investors that would be most interested in your startup and create a list of potential targets. - Network.

Attend industry events and conferences, join startup communities, and build relationships with influencers to expand your network. - Utilize social media.

Use LinkedIn, Twitter, and other social media platforms to connect with potential investors and share updates about your startup. - Create a pitch deck.

Develop a compelling pitch deck that highlights your team, business model, and growth potential to attract investor interest. - Create a video explainer.

Adding video explainer to your investors strategy can be an effective way to communicate your message and engage with target investors. Use eye-catching visuals and graphics to make your explainer video more visually appealing and engaging. Be sure to include a clear and compelling call-to-action at the end of your explainer video to encourage viewers to take action. - Leverage your existing network.

Reach out to your personal and professional network to seek introductions to investors that may be interested in your startup. - Join an accelerator or incubator program.

Accelerator or incubator programs can provide valuable resources, mentorship, and connections to investors. - Attend pitch events.

Participate in pitch events and pitch competitions to gain visibility and potentially secure funding. - Demonstrate traction.

Show investors that your startup is gaining traction by highlighting customer acquisition, revenue growth, and other key performance indicators. - Be prepared to answer tough questions.

Investors will want to know about your business model, competitive landscape, and financial projections, so be prepared to answer these questions. - Be persistent.

Connecting with investors can be challenging and time-consuming, but persistence can pay off. Follow up with potential investors and keep them updated on your progress.

Remember that connecting with investors is a process that takes time and effort, so be patient, stay focused, and continue to refine your approach to maximize your chances of success.

Pitching, nurturing and negotiating terms

Pitching your offer to the investor is a delicate process. You need to give them all of the information they need to give you a YES and have the right answers ready to the questions they are going to ask. Investors are typically cautious people, so you need to know how to nurture the prospect and anticipate their doubts or further questions.

Here are 10 tips for pitching, nurturing, and negotiating terms with investors:

- Do your research.

Before approaching investors, research their investment history and preferences to determine if they're a good fit for your company. - Focus on the big picture.

When pitching to investors, emphasize the potential upside and the large market your product addresses. - Prepare a compelling pitch.

Create a concise and persuasive pitch that clearly explains your product, market opportunity, and business model. - Re-frame anxiety as excitement.

To overcome negotiation anxiety, try re-framing it as excitement and focus on the potential positive outcomes of the negotiation. - Develop a BATNA.

Identify your Best Alternative to a Negotiated Agreement (BATNA) to understand your leverage in the negotiation process - Avoid non-negotiable offers.

Offers should rarely be non-negotiable, so try to defuse hard-bargaining tactics by focusing on the content of the offer and making a counter-offer that meets both parties' needs. - Show traction.

Demonstrate traction by highlighting customer acquisition, revenue growth, and other key performance indicators to build investor confidence - Be realistic.

Set realistic expectations and avoid over-promising to build trust with investors. - Nurture relationships.

Stay in touch with investors after the initial pitch to build long-term relationships and keep them updated on your company's progress. - Be flexible.

Be open to negotiating and compromising to find a mutually beneficial agreement that meets the needs of both parties.

Remember that connecting with investors is a process that takes time and effort, so be patient, stay focused, and continue to refine your approach to maximize your chances of success.

Closing the deal(s)

Finally, when the time comes to shake hands and receive the money, have you got the legal support to make sure that every box is ticked and all conditions are met? It’s easy to get excited as your goal is so close . . . but you can still lose everything at this last stage if you lack the correct deal-closing skills.

- Apply the assumptive close.

Use the assumptive close technique to gauge what a potential investor is thinking and assume they're ready to invest. By monitoring their objections and responses at every step of the sales process, you can determine when they're ready to make a commitment. - Offer regular updates.

Keep your investors informed about any changes or updates to your company, including news-related information, growth metrics, and legal or competitive issues. Keeping your investors up to date can help build trust and confidence in your company. - Demonstrate reliability.

Investors want to work with someone who follows through on their promises and is trustworthy. Be honest and transparent throughout the process to show investors that you're a reliable and honorable person. - Emphasize the customer.

Investors want to know that you're focused on solving real problems for your customers. Show investors that your product or service has a clear value proposition and that you understand your target market. - Think like an investor.

Put yourself in the investors' shoes and consider what they're looking for in an investment. Make sure you have a solid business plan, a clear path to profitability, and a strategy for scaling the business. Being prepared and demonstrating your understanding of the investors' perspective can help build confidence in your ability to deliver a return on their investment

Remember that connecting with investors is a process that takes time and effort, so be patient, stay focused, and continue to refine your approach to maximize your chances of success.

Action stage of fundraising journey in podcast episode

Aery Advisors founder Brad Furber and business development executive Yomi Bashorun review the ways to connect, engage and pitch investors, providing insight on negotiating terms and closing the deal(s).

Recommended Resources for Action Stage

Aery Advisors provides a range of services to startups at various stages and sizes, helping founders to understand the whole funding landscape and how to secure that all-important capital.

If you are the smart startup founder or business owner and you need an expert help in raising funds, look no further.

If you don’t have access to suitable investors for your startup OR prospective investors are not saying YES, you need a fundraising QuickFix.

The Startup Fundraising Quickfix is a bespoke coaching program to help you become investor-ready and help you identify your ideal investors in 90 days or less.

SeedGTM™ (Go To Market) Fundraising Program accelerates your seed round preparation and empowers you to begin fundraising with confidence.

On the road? Get a map!

Fundraising is a marathon, not a sprint. Securing funding is a long and complex process with many steps in between. You have to learn a different language and understand the world of investment to receive the critical funds. Wanting it isn’t enough!