2024 will undoubtedly go down as a transformational year in many ways, in many domains, and in many markets.Like all of you, the team at ...

Access the FREE Global Venture Finance Directory.

More than 3 867 + startup investors, communities and sources of capital.

Plus you will get a Free Investor Tracking Template.

Take the Investor Readiness Test and find it out.

More than 20.000+ Startup founders like you took it!

It takes just 2 minutes to finish the test.

Based on your answer you will get dynamically generated page (more than 106 Millions answer variations), with review of your current business state and what you need to do to become investor ready.

This short overview is designed to help startup founders map out a strategy and a process to identify, target, and close funding from their ideal sources of capital.

4 powerful venture finance video lessons that will help you learn the language startup investors expect to hear from you before they wire you money

Get your customized DREAM LIST of the TOP 100 investors ideal for your startup

based on your industry, region, and stage of development.

Does your startup have Venture Finance Advisor who can help you to raise money from investors, negotiate the deal and get the best terms?

If you don’t have access to suitable investors for your startup OR prospective investors are not saying YES, you need a fundraising quick fix

The Startup Fundraising Quickfix is a bespoke coaching program to help you become investor-ready and help you identify your ideal investors in 90 days or less.

We help you get investor ready, and coach you through the whole process, from beginning to end, through the ups and downs, for a period of 12 months, until you raise your next funding round

Ever how entrepreneurs and high-tech ventures "spin-out" technology from top research-intensive universities and other institutions, including how such spin-outs organize and negotiate their first round of seed capital from outside investors? Wonder no more.

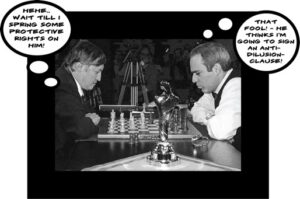

Term Sheet Battle - DTU (2021) is a live (and on-demand recording) between a real institutional investor and real "spin-off" entrepreneur, represented by a lawyer with real experience structuring and closing transactions of this nature. This program demystifies what is mostly a closed and poorly understood process: the first negotiation of a "term sheet" to launch finance and grow the spin-out startup. Read the full blog post about this event and the program.

Is your startup stuck or about to hit a wall?

As a trusted advisor, early investor or maybe even a co-founder in a startup you may need to share your concerns with an independent, objective and seasoned professional.

As an approved member of the OTC Markets Group Premium Provider Directory, we are directly linked to a European sponsor and we have an intricate understanding of the requirements.

We can facilitate your sponsorship application and speed up the process to get your shares quoted for trading within US public capital markets.

To find out if your company can achieve this in 90 days or less, just click the button below to schedule a FREE call with one of our advisors.

Access Public Capital Markets in US without the hassle, expense or liability of SEC registration.

2024 will undoubtedly go down as a transformational year in many ways, in many domains, and in many markets.Like all of you, the team at ...

Welcome to this comprehensive exploration of the fundraising landscape for startups in 2024. We will be drawing insights from the latest episode of our Fundraising ...

Wow, now that we have the first quarter of 2023 in the rear view mirror, we hope you and your team are still driving down ...

Startup Pitching WorkshopThe recent TNW Valencia event brought together some of the brightest minds in the tech industry, showcasing the region's rapidly growing innovation ecosystem. ...

So here we are in the middle of February 2023, smack dab in the middle of an increasingly dynamic climate for startup and emerging growth ...

The Fundraising Roadmap for FoundersMany founders are looking for the next funding round that could represent the critical growth or – in some cases – ...

An innovative “side door” entry into the lucrative US capital marketMany companies dream of going public and listing their business on a national stock exchange. ...

Startup fundraising in a changed market The first thing to say is that the age of easy money is over. Most people in the financial ...

As we all know, 2022 has brought about significant changes in the global economic and political landscape. For founders, funders, and managers of startup and ...

At Aery Advisors, we are constantly looking for ways to give back to the Global Startup Ecosystem, especially founders and funders looking to innovate, to ...

Printify, Inc., headquartered in Riga, Latvia, announced the successful closing of a $45 Million Series A financing led by Index Ventures, H&M Group and Virgin ...

Ever wonder how entrepreneurs and high-tech ventures "spin-out" technology from top research-intensive universities and other institutions, including how such spin-outs organize and negotiate their first ...

You may opt out at any time using the unsubscribe function provided in the emails.

200+

Angel and venture capital financings

50+

Mergers and acquisitions

10+

Public offerings

$1B+

Aggregate capital financing raised

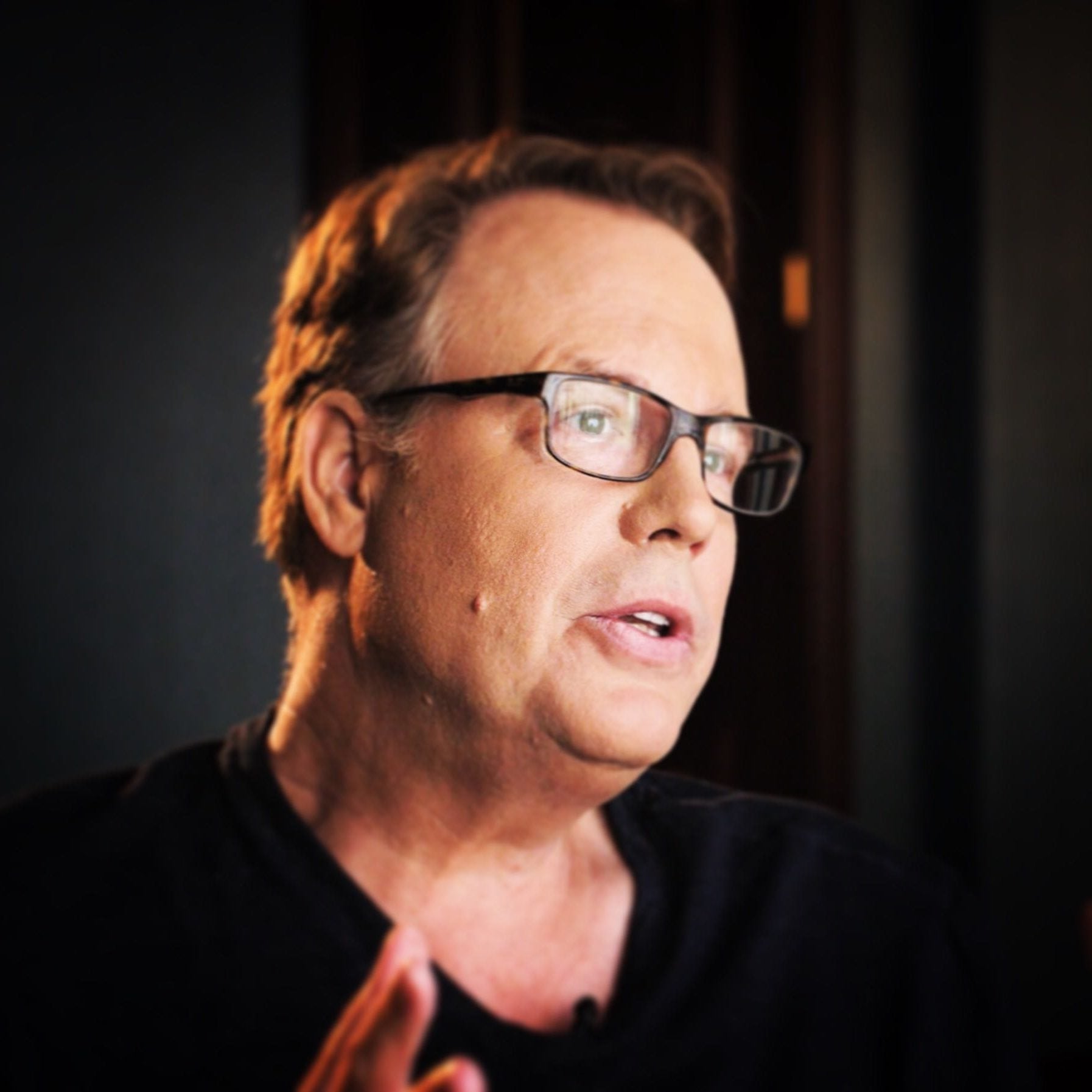

I’m Brad Furber. I’m a seed investor, company advisor, entrepreneur and lawyer who’s been working closely with funders, intermediaries, founders and visionary entrepreneurs just like you during my entire professional career.

I’ve been a strategic mentor, advisor and angel investor in 50+ tech startups, 15 of which have already achieved an exit or liquidity event. I served as President and CEO of a bootstrapped and profitable consumer Internet software + services global tech startup, co-founder of an innovative law firm for startups and emerging growth companies, and founding business leader of a cross-faculty innovation centre at one of the world’s top 50 research intensive universities.

I’ve been engaged to advise on more than 150 angel and venture capital financings, more than 50 mergers and acquisitions, and 10+ public offerings.

Over the past ten years, I’ve lived and worked in four countries – the USA, Denmark, Australia and now Switzerland. I understand that each region and each jurisdiction has its own unique culture and way of doing deals. I’ve seen first hand what’s worked and what hasn’t. Venture finance is not one size fits all. It requires empathy, design thinking, legal, financial and marketing know-how, strategy, persistence and true grit.

"

I spoke to a startup founder with a $400K investment from a local investor. He was planning to spend it all to generate $200K revenue. I suggested it might be smarter to spend some of it, say $15K, on a compelling venture finance offer that could improve his balance sheet by $1M or more. That’s what I’m talking about – building foundations and capabilities, and selling your dream to investors who can help you innovate, compete and grow.

Now I`m providing (non-legal) professional Advisory services for serious startup co-founders and funders, who seek sophisticated advice and expertise to face complex business challenges.

I want to help you help yourself – by sharing access to knowledge, expertise and networks that will enable you to meet and exceed your venture finance goals and objectives.