Instant access to fundamental Venture Finance knowledge online + personalized discovery and advisory services

Online course + 30 min. advisory call

that will help you learn

the language startup investors expect to hear from you before they wire you money.

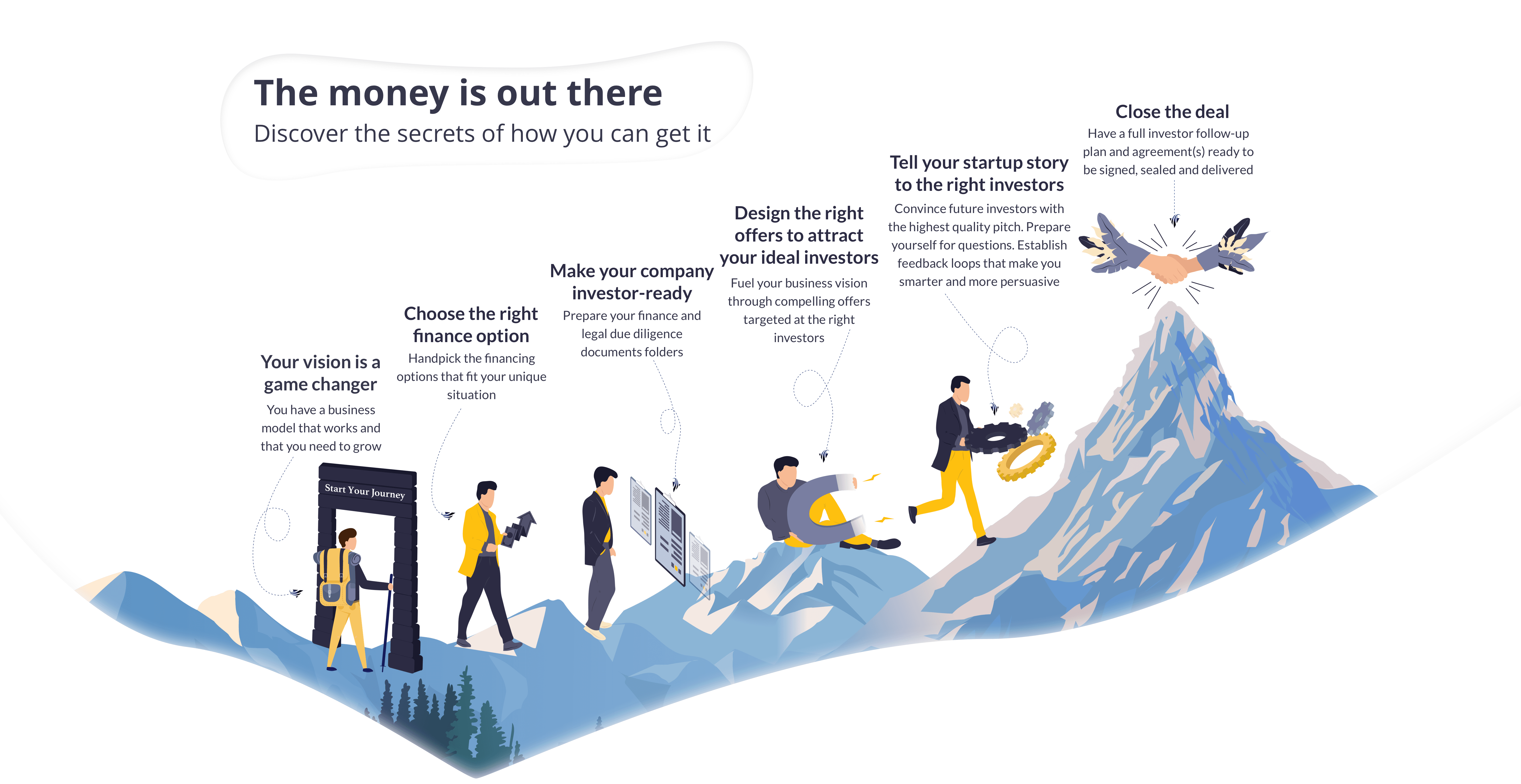

The short, two-hour Masterclass goes into more depth about the four key principles of raising money.

Lesson 1 - Venture Finance Foundational Knowledge (45 min.)

where you will learn all about the different ways you can raise money.

Lesson 2 - Get Your House in Order (18 min.)

where you will learn exactly what you need to do to get ready for investment from real investors.

Lesson 3 - Create A Compelling Offer (29 min.)

where you will learn exactly how to design an offer that will attract and close your ideal type of funding source

Lesson 4 - Go To Market (37 min.)

where you will learn how to strategically source leads, conduct pitches and meetings, negotiate and close your venture finance deals

It’s one thing to hear and see the information, but smart entrepreneurs like to have it written for handy reference.

With the pre-prepared Venture Finance 101 PDF book, your notes will be easier to make and you’ll be able to follow the videos to make an action plan.

Like to listen and learn while you are driving or jogging? You’ll love these downloadable audio files.

You can listen to the Venture Finance Masterclass audio on your mobile phone, in-car or on any device you prefer at any time you want.

Get clarity on how you can use the Masterclass to develop your funding plan and where you can go for more help. You will be able to schedule a 30-min call with one of our venture finance advisors.

Your investment is safe with us.

Aery Advisors digital products come with a 100% no-risk, 30-day money-back guarantee policy.

Join completely risk free!

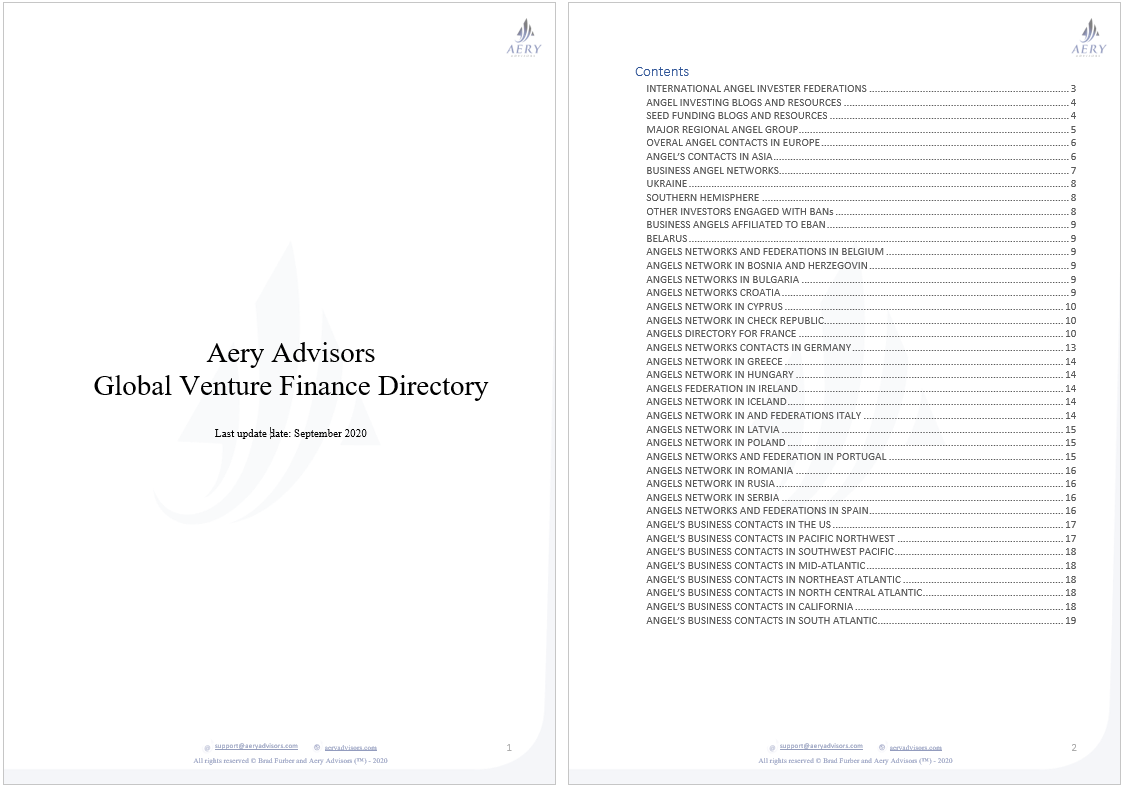

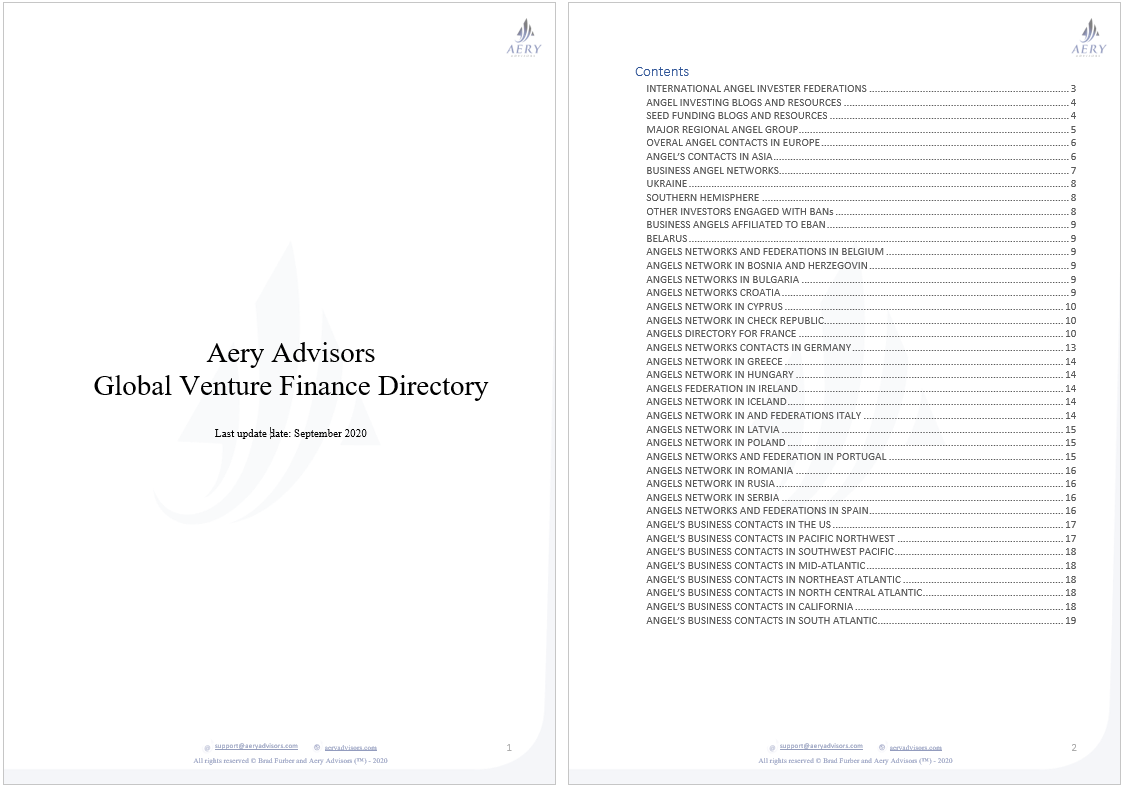

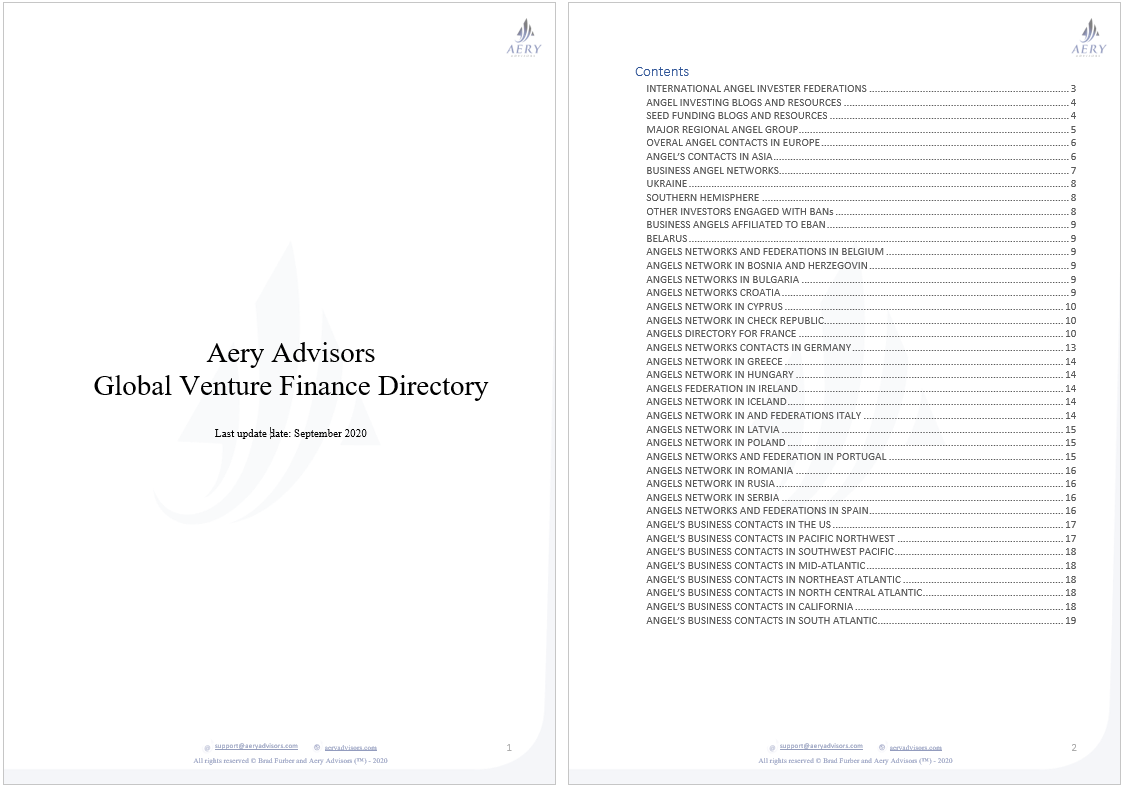

#1 The Global Venture Finance Directory

A lot of startup founders on the Investor Readiness Test mentioned that they don't know where to start looking for third-party financing.

This Global Venture Finance Directory contains hundreds of contacts where you can start your journey to approach investors both locally and globally.

We constantly add new list from other startup communities. Currently we have lists of more than 10.000 investment sources.

Value €197/year

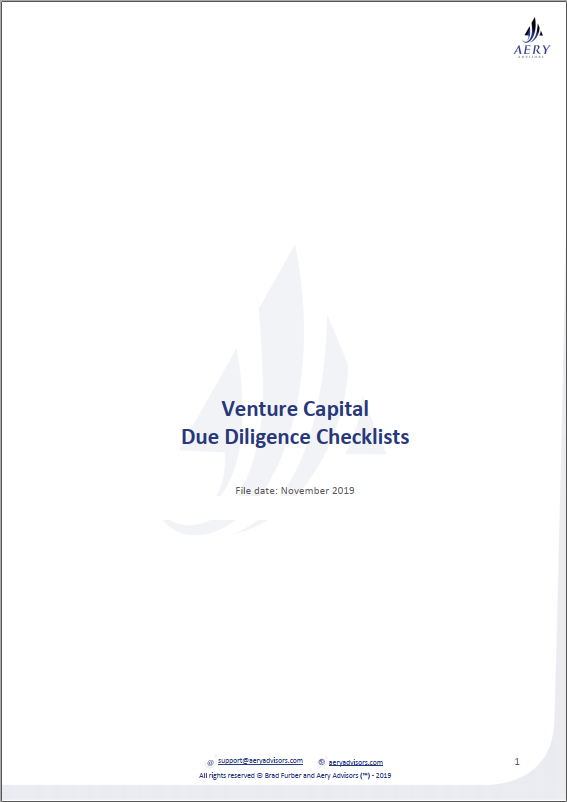

#2 Due Diligence Checklists (3 examples)

If you are raising money from a sophisticated investor, you’ll need to respond to a due diligence request. We have three Due Diligence checklist examples.

Using these checklist, you can prepare your investor toolkit in a way that ensures that you've included all information the investors need to make their decision.

Value €197

#3 Simple Agreement For Future Equity offer 4 examples

Y Combinator introduced the SAFE (Simple Agreement for Future Equity) in late 2013. Since then, it has been used by almost all YC startups and countless non-YC startups as the main instrument for early-stage fundraising.

These document templates will help you to approach pre-seed stage investors with the right VENTURE FINANCE OFFER structure.

Please note: you should customize and adapt them to your legal entity jurisdiction with the help of your legal advisors or lawyers.

Value €197

#4 Access to Venture Finance Podcasts

All your questions answered in the bi-monthly venture finance podcasts.

Value €97/year

#5 Exclusive startup founder and CEOs community

Join the growing community of startup founders and CEOs like you

INVALUABLE!

#6 Practical video Case Study (2 hours)

with one of Venture Finance Academy students Sam Cook from SanityDesk.

5 parts video lessons with practical examples how SanityDesk raised $1.35M pre-seed round during a global pandemic.

INVALUABLE!

Bonus package value €688+

1 hour Investor Readiness Test review

that will help you learn

the language startup investors expect to hear from you before they wire you money.

The short, two-hour Masterclass goes into more depth about the four key principles of raising money.

Lesson 1 - Venture Finance Foundational Knowledge (45 min.)

where you will learn all about the different ways you can raise money.

Lesson 2 - Get Your House in Order (18 min.)

where you will learn exactly what you need to do to get ready for investment from real investors.

Lesson 3 - Create A Compelling Offer (29 min.)

where you will learn exactly how to design an offer that will attract and close your ideal type of funding source

Lesson 4 - Go To Market (37 min.)

where you will learn how to strategically source leads, conduct pitches and meetings, negotiate and close your venture finance deals

It’s one thing to hear and see the information, but smart entrepreneurs like to have it written for handy reference.

With the pre-prepared Venture Finance 101 PDF book, your notes will be easier to make and you’ll be able to follow the videos to make an action plan.

Like to listen and learn while you are driving or jogging? You’ll love these downloadable audio files.

You can listen to the Venture Finance Masterclass audio on your mobile phone, in-car or on any device you prefer at any time you want.

Get clarity on how you can use the Masterclass to develop your funding plan and where you can go for more help. You will be able to schedule a 30-min call with one of our venture finance advisors.

Your investment is safe with us.

Aery Advisors digital products come with a 100% no-risk, 30-day money-back guarantee policy.

Join completely risk free!

#1 The Global Venture Finance Directory

A lot of startup founders on the Investor Readiness Test mentioned that they don't know where to start looking for third-party financing.

This Global Venture Finance Directory contains hundreds of contacts where you can start your journey to approach investors both locally and globally.

We constantly add new list from other startup communities. Currently we have lists of more than 10.000 investment sources.

Value €197/year

#2 Due Diligence Checklists (3 examples)

If you are raising money from a sophisticated investor, you’ll need to respond to a due diligence request. We have three Due Diligence checklist examples.

Using these checklist, you can prepare your investor toolkit in a way that ensures that you've included all information the investors need to make their decision.

Value €197

#3 Simple Agreement For Future Equity offer 4 examples

Y Combinator introduced the SAFE (Simple Agreement for Future Equity) in late 2013. Since then, it has been used by almost all YC startups and countless non-YC startups as the main instrument for early-stage fundraising.

These document templates will help you to approach pre-seed stage investors with the right VENTURE FINANCE OFFER structure.

Please note: you should customize and adapt them to your legal entity jurisdiction with the help of your legal advisors or lawyers.

Value €197

#4 Access to Venture Finance Podcasts

All your questions answered in the bi-monthly venture finance podcasts.

Value €97/year

#5 Exclusive startup founder and CEOs community

Join the growing community of startup founders and CEOs like you

INVALUABLE!

#6 Practical video Case Study (2 hours)

with one of Venture Finance Academy students Sam Cook from SanityDesk.

5 parts video lessons with practical examples how SanityDesk raised $1.35M pre-seed round during a global pandemic.

INVALUABLE!

Bonus package value €688+

1-hour personal Investor Readiness Test results review with one of our Venture Finance Advisors

1 hour Advisory Call with Brad Furber

that will help you learn

the language startup investors expect to hear from you before they wire you money.

The short, two-hour Masterclass goes into more depth about the four key principles of raising money.

Lesson 1 - Venture Finance Foundational Knowledge (45 min.)

where you will learn all about the different ways you can raise money.

Lesson 2 - Get Your House in Order (18 min.)

where you will learn exactly what you need to do to get ready for investment from real investors.

Lesson 3 - Create A Compelling Offer (29 min.)

where you will learn exactly how to design an offer that will attract and close your ideal type of funding source

Lesson 4 - Go To Market (37 min.)

where you will learn how to strategically source leads, conduct pitches and meetings, negotiate and close your venture finance deals

It’s one thing to hear and see the information, but smart entrepreneurs like to have it written for handy reference.

With the pre-prepared Venture Finance 101 PDF book, your notes will be easier to make and you’ll be able to follow the videos to make an action plan.

Like to listen and learn while you are driving or jogging? You’ll love these downloadable audio files.

You can listen to the Venture Finance Masterclass audio on your mobile phone, in-car or on any device you prefer at any time you want.

Get clarity on how you can use the Masterclass to develop your funding plan and where you can go for more help. You will be able to schedule a 30-min call with one of our venture finance advisors.

Your investment is safe with us.

Aery Advisors digital products come with a 100% no-risk, 30-day money-back guarantee policy.

Join completely risk free!

#1 The Global Venture Finance Directory

A lot of startup founders on the Investor Readiness Test mentioned that they don't know where to start looking for third-party financing.

This Global Venture Finance Directory contains hundreds of contacts where you can start your journey to approach investors both locally and globally.

We constantly add new list from other startup communities. Currently we have lists of more than 10.000 investment sources.

Value €197/year

#2 Due Diligence Checklists (3 examples)

If you are raising money from a sophisticated investor, you’ll need to respond to a due diligence request. We have three Due Diligence checklist examples.

Using these checklist, you can prepare your investor toolkit in a way that ensures that you've included all information the investors need to make their decision.

Value €197

#3 Simple Agreement For Future Equity offer 4 examples

Y Combinator introduced the SAFE (Simple Agreement for Future Equity) in late 2013. Since then, it has been used by almost all YC startups and countless non-YC startups as the main instrument for early-stage fundraising.

These document templates will help you to approach pre-seed stage investors with the right VENTURE FINANCE OFFER structure.

Please note: you should customize and adapt them to your legal entity jurisdiction with the help of your legal advisors or lawyers.

Value €197

#4 Access to Venture Finance Podcasts

All your questions answered in the bi-monthly venture finance podcasts.

Value €97/year

#5 Exclusive startup founder and CEOs community

Join the growing community of startup founders and CEOs like you

INVALUABLE!

#6 Practical video Case Study (2 hours)

with one of Venture Finance Academy students Sam Cook from SanityDesk.

5 parts video lessons with practical examples how SanityDesk raised $1.35M pre-seed round during a global pandemic.

INVALUABLE!

Bonus package value €688+

1-hour personal Investor Readiness Test results review with one of our Venture Finance Advisors

Take advantage of this opportunity to speak for 60 mins with Brad Furber about your business idea, your finance strategy, and to discuss how he can personally help you with your journey.

High level personalized Venture Finance Advisory help for your startup

1-3 calls

Get independent, objective, insights and advice

When a problem or an opportunity is big enough, it's always a good idea to seek independent, objective, insights and advice from more than one source.

We are frequently asked to weigh in on proposed alternative and/or preferred financing strategies, securities offers (e.g., pre-seed valuation caps vs discounts vs warrants, etc.), deal point negotiations (in both Angel and VC lead financings, aka Term Sheet Battle (TM), co-founder equity allocations (and divorces), value creation (built to sell) models, university tech transfer, corporate innovation/CVC, liquidity options through private and public secondary markets, intermediary engagement terms, buy and sell-side mandates, and the like.

Scan: Understanding the context, opportunity and challenge from the current perspective of the client.

Focus: A conversation to explore, discuss, ideate, spar and assess best next steps.

Act - Providing a concise assessment of current state and proposed alternative and preferred next steps for client.

90 days program

We review your startup current state and help you to become investors ready, and coach you through the process during 3 month period

to determine your current state and what remains to be done to get to your preferred future state.

Take a Complete Venture Finance Audit to discover what you need to do to get Finance Ready

You can access all instructions and online resources in the members area for 90 days.

To review the results of your venture Finance Audit, understand what you need to do to get funding ready, and get his personal feedback on your documents and presentation over a 3 month period.

1) initial consultation and coaching instructions

2) questionnaire assessment of strengths and gaps, and tailored next steps;

3) review and assess quality of the minimum viable offer and toolkit and strategy, and tailored next steps.

90 days access to 4.5 Hours of Detailed Venture Finance PRO Masterclass online course with 42 video lessons.

Condense months of your time into just 4.5-hours of Venture Finance PRO Masterclass video course on the essentials of creating your compelling minimum viable offer.

One time invitation to bi-weekly Group Coaching Calls for Venture Finance Academy members with Brad Furber and other students focused on a specific part of the knowledge base and toolkit, including opportunity to ask questions and receive answers from seasoned experts (including guest speakers), and “peer to peer” learning and sharing among other like-minded and similar situated entrepreneurs.

* Downloadable material with step-by-step checklists to help you perfect your offer.

* A library of essential curated resources and templates

(36 documents), which will be supplemented if necessary to address your unique facts and circumstances tailored to your company and jurisdiction.

* Downloadable templates (e.g., model agreements, pitch decks, and due diligence matters) that will save you time and money.

* Global Venture Finance Directory (Angel networks with contact information, Family offices, etc) You will know where to start looking for investors locally and globally.

* Downloadable templates (e.g., model agreements, pitch decks, and due diligence matters) that will save you time and money.

* Printable Worksheets that will allow you to create all the documents you need to get business funding.

* Printable PDF Slide Decks that will allow you to follow along and take notes as you go through the presentations.

* Printable Transcripts of the videos that will allow you to follow every part of the course and refer back to it for easy reference

If there is a venture finance challenge that we can’t help you address directly, we will do our best to help you identify someone or someplace that can!

12 months program

We review your startup current state and help you to become investors ready, and coach you through the process during 12 month period

to determine your current state and what remains to be done to get to your preferred future state.

Take a Complete Venture Finance Audit to discover what you need to do to get Finance Ready

You can post questions for Brad, members of his team, and other members of the Academy while you are on your venture Finance Audit (during a 12 months period).

To review the results of your venture Finance Audit, understand what you need to do to get funding ready, and get his personal feedback on your documents and presentation over a 12 month period.

1) initial consultation and coaching instructions

2) questionnaire assessment of strengths and gaps, and tailored next steps;

3) review and assess quality of the minimum viable offer and toolkit and strategy, and tailored next steps;

4) final review of the minimum viable offer and toolkit and strategy, and tailored next steps post-accelerator;

5) Two one hour 1-on-1 personal AMA (Ask me Anything) calls

1 year access to two hours bi-weekly Group Coaching Calls and all recording on Venture Finance with Brad Furber and other students focused on a specific part of the knowledge base and toolkit, including opportunity to ask questions and receive answers from seasoned experts (including guest speakers), and “peer to peer” learning and sharing among other like-minded and similar situated entrepreneurs

Lifetime Access to 4.5 Hours of Detailed Venture Finance PRO Masterclass online course with 42 video lessons.

Condense months of your time into just 4.5-hours of Venture Finance PRO Masterclass video course on the essentials of creating your compelling minimum viable offer.

* Downloadable material with step-by-step checklists to help you perfect your offer.

* A library of essential curated resources and templates

(36 documents), which will be supplemented if necessary to address your unique facts and circumstances tailored to your company and jurisdiction.

* Downloadable templates (e.g., model agreements, pitch decks, and due diligence matters) that will save you time and money.

* Global Venture Finance Directory (Angel networks with contact information, Family offices, etc) You will know where to start looking for investors locally and globally.

* Downloadable templates (e.g., model agreements, pitch decks, and due diligence matters) that will save you time and money.

* Printable Worksheets that will allow you to create all the documents you need to get business funding.

* Printable PDF Slide Decks that will allow you to follow along and take notes as you go through the presentations.

* Printable Transcripts of the videos that will allow you to follow every part of the course and refer back to it for easy reference

If there is a venture finance challenge that we can’t help you address directly, we will do our best to help you identify someone or someplace that can!

200+

Angel and venture capital financings

50+

Mergers and acquisitions

10+

Public offerings

$1B+

Aggregate capital financing raised

I’m Brad Furber. I’m a seed investor, company advisor, entrepreneur and lawyer who’s been working closely with funders, intermediaries, founders and visionary entrepreneurs just like you during my entire professional career.

I’ve been a strategic mentor, advisor and angel investor in 50+ tech startups, 15 of which have already achieved an exit or liquidity event. I served as President and CEO of a bootstrapped and profitable consumer Internet software + services global tech startup, co-founder of an innovative law firm for startups and emerging growth companies, and founding business leader of a cross-faculty innovation centre at one of the world’s top 50 research intensive universities.

I’ve been engaged to advise on more than 150 angel and venture capital financings, more than 50 mergers and acquisitions, and 10+ public offerings.

Over the past ten years, I’ve lived and worked in four countries – the USA, Denmark, Australia and now Switzerland. I understand that each region and each jurisdiction has its own unique culture and way of doing deals. I’ve seen first hand what’s worked and what hasn’t. Venture finance is not one size fits all. It requires empathy, design thinking, legal, financial and marketing know-how, strategy, persistence and true grit.

"

I spoke to a startup founder with a $400K investment from a local investor. He was planning to spend it all to generate $200K revenue. I suggested it might be smarter to spend some of it, say $15K, on a compelling venture finance offer that could improve his balance sheet by $1M or more. That’s what I’m talking about – building foundations and capabilities, and selling your dream to investors who can help you innovate, compete and grow.

Now I`m providing (non-legal) professional Advisory services for serious startup co-founders and funders, who seek sophisticated advice and expertise to face complex business challenges.

I want to help you help yourself – by sharing access to knowledge, expertise and networks that will enable you to meet and exceed your venture finance goals and objectives.

Printify Inc., headquartered in Riga, Latvia, announced in September 2021 that it successfully closed a $45 Million Series A financing, led by Index Ventures, H&M Group and Virgin Group.

“I think the most expensive thing in business is the mistakes you make and mistakes in terms of the direction of where you want to bring the company, and the time you waste in going the wrong direction or focusing on the wrong thing.

And if you have somebody experienced like Brad, that is huge because it can save you a ton of money.

Having the possibility to have the advice from somebody who has been there and done that before is incredibly valuable.”

-James Berdigans Founder and CEO of Printify.com

Aery Advisors’ founder Brad Furber has been working with the co-founders of Printify since late 2016. Since that time Brad has participated in multiple financing rounds, including Printify’s Series A round. Over the years, Brad has acted on behalf of Printify in multiple capacities, including as mentor, coach, strategic litigation manager, Series A term sheet negotiator, and outside advisor to counsel Printify going forward in connection with its print on demand platform scale up globally.

ZEMP's product suite enables small and medium businesses to sell across channels, manage operations across all core disciplines, engage with customers, accept payments and ultimately grow their business.

When I started talking to the first potential investors and they asked "Can I have a look into your data room" and I was prepared. It was a very positive thing. It was much easier to get traction in the market. It was first preparation of 3 months and 4 months of negotiations with investors. All in all, within 7 months we raised 1.3 million dollars.

Brad was tangible, we had open conversations, coaching sessions, I had trust in him because he’s done it, he went through it, he talks from experience, and he has a very huge heritage. You accepted his advice because it worked. It is not a standard class. This is bespoke sessions with him where he focused and adapted his knowledge to my needs.

I would definitely 100% recommend it. I believe there is nothing that cannot be improved so no one has ever got from me a 10, as there is always room to improve, but I would say the experience has been a clear 9 for me.

Founder of Zemp Business Solutions

Lucerne, Switzerland | zemp.io

iPromote, headquartered in San Luis Obisbo, California, provides digital advertising technology and solutions designed to help underserved SMBs access the high growth programmatic digital advertising market in an efficient and cost-effective way.

If I could do it over again, I would compress the time that we spent in the early years and bring in expertise as early as possible to make sure that you're enlisting people that have that explicit knowledge, that “been there, done that" experience, to help guide you move forward.

I was fortunate that I've known Brad for a long time. I've known him since he was 20 years old and I've participated with him, watching him work all around the world. He has extensive experience helping entrepreneurs, startups and emerging growth companies raise capital globally.

In July 2021, Cohere Capital, a Boston-based private equity firm made a strategic growth investment (8 figures) in iPromote.

- Gregg Albright, CEO of iPromote

Choose your option today and start raising money for your startup