Startup Fundraising Kickstart

Kickstart your fundraising in 90 days or less

Kickstart your fundraising in 90 days or less

Some of the greatest challenges faced by Founders and CEOs of early-stage startups in their quest for funding is a lack of knowledge on the key principles of raising capital, finding the right level of support to become investor-ready, and access to a prospect list of ideal investors to pitch.

The Startup Fundraising Kickstart is an online program designed for founders and CEOs of early stage startups who are seeking a clear roadmap to closing their next funding round with their ideal investors.

During the three-months program you will receive 1-on-1 advice, a funding assessment, a masterclass in venture finance, pitch training, guidance on becoming investor ready, and a customized prospect list of top ideal investors to pitch.

You will no longer be alone on your fundraising journey. You will always have support from a team who has been there and done that countless times for startups all over the world.

Investor Readiness Assessment

Complete the Investor Readiness Test and review the results with one of our Venture Finance Advisors on a 1-on-1 call.

Venture Finance Masterclass (Basic & Pro)

Firstly access to the Basic Venture Finance Masterclass online course with 4 video lessons to learn the key principles of raising money. Then graduate to the Venture Finance Masterclass Pro with 42 video lessons to dive deeper into the key principles of raising money.

One-on-One Discovery Call

Attend a Discovery Call with a Venture Finance Advisor to discuss your startups funding challenges, aspirations, and identify the exact steps needed to attract the investment you want.

Pitch Training

Access to the Pitch Coaching Academy online course with a full step by step guide to creating your winning pitch. Actionable tips and tools that help you communicate your value with support from a pitch coach at anytime.

Investor Dream List

Receive your customized dream list of TOP 100 investors from one of the largest global proprietary databases. Attend a 1-on-1 call with one of our Advisors to refine your custom search criteria and receive your investor dream list within 7 days.

Essential Resources

A library of essential curated resources and downloadable templates to enable you to move faster (including model agreements, pitch decks, term sheet examples, due diligence checklists, Ebooks, and access to our Global Venture Finance Directory with more than 3,877+ sources of capital).

Welcome to Startup Fundraising Kickstart Program

Investor Readiness Test

Lesson 1: Foundational Knowledge

Lesson 2: House in Order

Lesson 3: Venture Finance Offer(s)

Lesson 4: Marketing your Offer(s)

Book Your Venture Finance Discovery Call

Welcome note

Lesson 1: Founder’s mindset

Lesson 1: Choice of business entity & the three basic building blocks

Lesson 2: Common Securities and Instruments overview

Lesson 3: Key Economic Terms and Conditions

Lesson 4: Key Control Terms and Conditions

Lesson 5: Other Negotiable Terms and Conditions

Lesson 6: Sweat Equity

Lesson 7: Innovation in Venture Finance

Lesson 8: Summary of foundation venture finance knowledge

Lesson 1: Introduction

Lesson 2: How to make your house in order

Lesson 3: Due diligence process

Lesson 4: Management, employees, consultants

Lesson 5: Debt financing

Lesson 6: Other material agreements

Lesson 7: Summary of ‘House in order’

Lesson 1: Introduction

Lesson 2: Investor personas and empathy maps

Lesson 3: 10 investor profiles

Lesson 4: Friends, Family and Fools

Lesson 5: Crowdfunding

Lesson 6: Business Accelerator

Lesson 7: Business incubators

Lesson 8: Angel investors

Lesson 9: Super angels

Lesson 10: Micro VCs

Lesson 11: Traditional VCs

Lesson 12: Corporate innovation groups and corporate VCs

Lesson 13: Venture debt or venture leasing

Lesson 14: ICO’s and STO’s

Lesson 15: Government support and services

Lesson 16: Summary

Lesson 1: Introduction

Lesson 2: The go to market toolkit

Lesson 3: Commitment to do what it takes

Lesson 4: Common ways to secure leads

Lesson 5: Finders

Lesson 6: Pitching and closing

Lesson 7: How long does it take?

Lesson 8: Probabilities of success

Lesson 9: Summary

Lesson 1: Course summary and the next steps

Connect to your Pitch Academy Account

Investor Prospect Dream List Service

Webinar: How to approach and engage smart money investors

Prepare your Fundraising Toolkit

Investor Prospecting Files

Leave your Feedback

Certificate Request

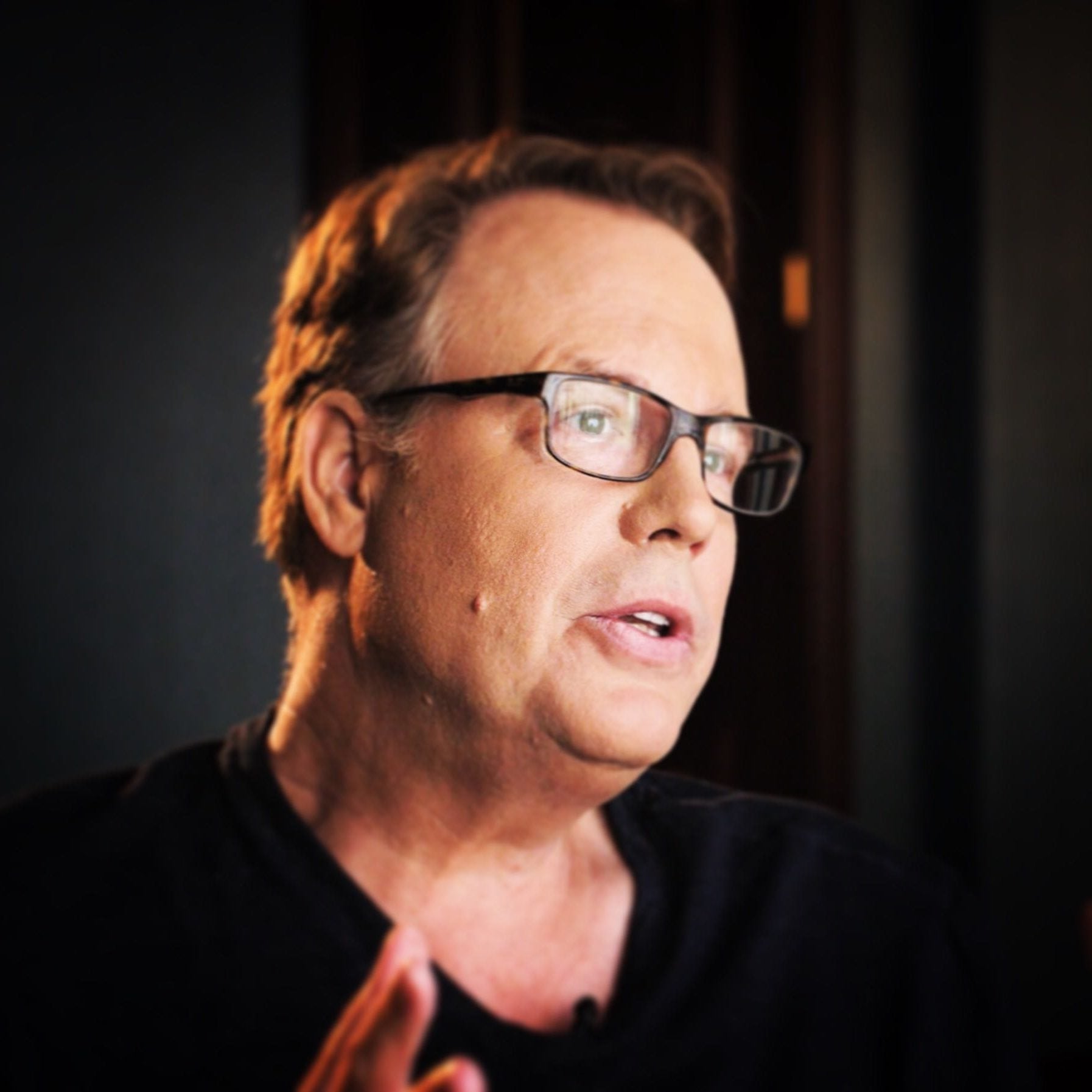

Consultation with Brad Furber

Startup Fundraising Quickfix

Venture Finance Academy

Venture Finance Masterclass Basic Files

Global Venture Finance Directory

Masterclass Pro Library

Venture Finance Masterclass Pro Slides

SAFE Note Agreement

KISS Note Agreement Templates

SAFT Project Document Templates

Series A Document Templates

Seed funding Stage Document Templates

Due Diligence Checklist Examples

Industry Trends and Statistics

Save Money on Software

Investor Prospecting Files

Bonus lesson introduction

Part 1 – How to Build Your Fundraising Strategy (The 12 Sources of Capital)

Part 2 – Getting Your House in Order [Skip this step & Die]

Part 3 – Creating a Compelling Offer [It’s a LOT harder than Sales]

Part 4 – Going to Market [The Long Journey Ahead]

12 months access to all digital products and

90-days personal support

3 payments

€1500/monthly

One-time payment

€3995

Printify Inc., headquartered in Riga, Latvia, announced in September 2021 that it successfully closed a $45 Million Series A financing, led by Index Ventures, H&M Group and Virgin Group.

“I think the most expensive thing in business is the mistakes you make and mistakes in terms of the direction of where you want to bring the company, and the time you waste in going the wrong direction or focusing on the wrong thing.

And if you have somebody experienced like Brad, that is huge because it can save you a ton of money.

Having the possibility to have the advice from somebody who has been there and done that before is incredibly valuable.”

-James Berdigans Founder and CEO of Printify.com

Aery Advisors’ founder Brad Furber has been working with the co-founders of Printify since late 2016. Since that time Brad has participated in multiple financing rounds, including Printify’s Series A round. Over the years, Brad has acted on behalf of Printify in multiple capacities, including as mentor, coach, strategic litigation manager, Series A term sheet negotiator, and outside advisor to counsel Printify going forward in connection with its print on demand platform scale up globally.

ZEMP's product suite enables small and medium businesses to sell across channels, manage operations across all core disciplines, engage with customers, accept payments and ultimately grow their business.

When I started talking to the first potential investors and they asked "Can I have a look into your data room" and I was prepared. It was a very positive thing. It was much easier to get traction in the market. It was first preparation of 3 months and 4 months of negotiations with investors. All in all, within 7 months we raised 1.3 million dollars.

Brad was tangible, we had open conversations, coaching sessions, I had trust in him because he’s done it, he went through it, he talks from experience, and he has a very huge heritage. You accepted his advice because it worked. It is not a standard class. This is bespoke sessions with him where he focused and adapted his knowledge to my needs.

I would definitely 100% recommend it. I believe there is nothing that cannot be improved so no one has ever got from me a 10, as there is always room to improve, but I would say the experience has been a clear 9 for me.

Founder of Zemp Business Solutions

Lucerne, Switzerland | zemp.io

iPromote, headquartered in San Luis Obisbo, California, provides digital advertising technology and solutions designed to help underserved SMBs access the high growth programmatic digital advertising market in an efficient and cost-effective way.

If I could do it over again, I would compress the time that we spent in the early years and bring in expertise as early as possible to make sure that you're enlisting people that have that explicit knowledge, that “been there, done that" experience, to help guide you move forward.

I was fortunate that I've known Brad for a long time. I've known him since he was 20 years old and I've participated with him, watching him work all around the world. He has extensive experience helping entrepreneurs, startups and emerging growth companies raise capital globally.

In July 2021, Cohere Capital, a Boston-based private equity firm made a strategic growth investment (8 figures) in iPromote.

- Gregg Albright, CEO of iPromote

150+

Angel and venture capital financings

50+

Mergers and acquisitions

10+

Public offerings

$ 1B+

Aggregate capital financing raised

I’m Brad Furber. I’m a seed investor, company advisor, entrepreneur and lawyer who’s been working closely with funders, intermediaries, founders and visionary entrepreneurs just like you during my entire professional career.

I’ve been a strategic mentor, advisor and angel investor in 50+ tech startups, 15 of which have already achieved an exit or liquidity event. I served as President and CEO of a bootstrapped and profitable consumer Internet software + services global tech startup, co-founder of an innovative law firm for startups and emerging growth companies, and founding business leader of a cross-faculty innovation centre at one of the world’s top 50 research intensive universities.

I’ve been engaged to advise on more than 150 angel and venture capital financings, more than 50 mergers and acquisitions, and 10+ public offerings.

Over the past ten years, I’ve lived and worked in four countries – the USA, Denmark, Australia and now Switzerland. I understand that each region and each jurisdiction has its own unique culture and way of doing deals. I’ve seen first hand what’s worked and what hasn’t. Venture finance is not one size fits all. It requires empathy, design thinking, legal, financial and marketing know-how, strategy, persistence and true grit.

That is what I am sharing in this course.

"

I spoke to a startup founder with a $400K investment from a local investor. He was planning to spend it all to generate $200K revenue. I suggested it might be smarter to spend some of it, say $15K, on a compelling venture finance offer that could improve his balance sheet by $1M or more. That’s what I’m talking about – building foundations and capabilities, and selling your dream to investors who can help you innovate, compete and grow.

I want to help you help yourself – by sharing access to knowledge, expertise and networks that will enable you to meet and exceed your venture finance goals and objectives.