Aery Advisors helps founders, funders and teams turn big ideas into reality.

Between June 29th and September 21st, 2020, a total of 649 individuals from 55 countries who self-identify as a startup founder or business owner completed the Aery Advisors “Investor Readiness Test”. This straightforward yet comprehensive test includes 17 questions, nine of which are multiple choice and eight of which are open-ended. The purpose of this test is to assess how “ready” the individual and his or her startup idea or venture is to engage in the process of raising funding from third party sources. This article will illustrate the aggregate data compiled from our test respondents during the test period.

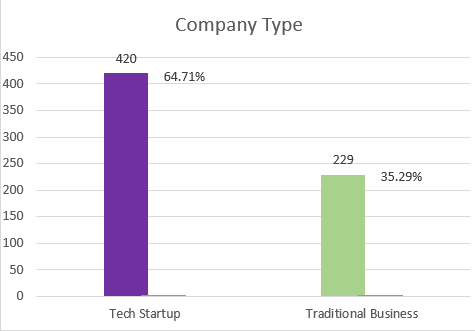

Type of Venture - Tech or Traditional Business

As illustrated by the graph, 65% of respondents indicated they are working on a tech start-up venture and approximately 35% are working on a traditional business start-up venture.

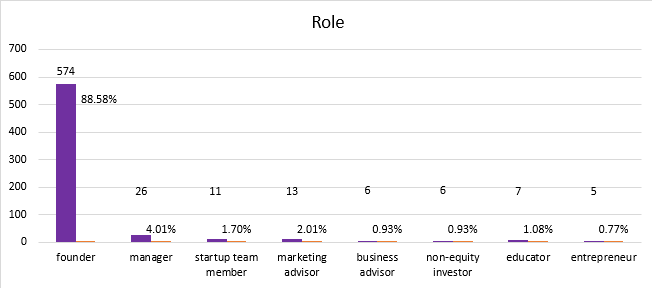

Respondent’s Role

We targeted our marketing for test respondents to startup founders and business owners and, accordingly, it is no surprise that almost 89% of our respondents self-identified as a founder of their respective startup or business.

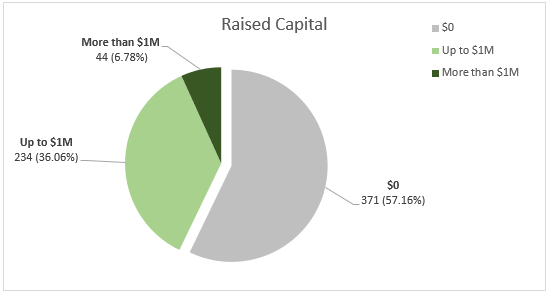

Capital Raised from Third Parties To Date

The test asked respondents to disclose the aggregate capital that their venture or business has already raised from third party sources in any form (including, equity, debt, grants, crowdfunding and the like). Approximately 57% of respondents disclosed that they have not raised any funding from third parties yet. By comparison, approximately 7% of respondents disclosed that they have already raised more than US$ 1 Million. 36% of respondents had already raised some capital from third party sources, but less than US$ 1 Million. Put another way, 43% of respondents reported that they have already achieved some success in the venture finance arena.

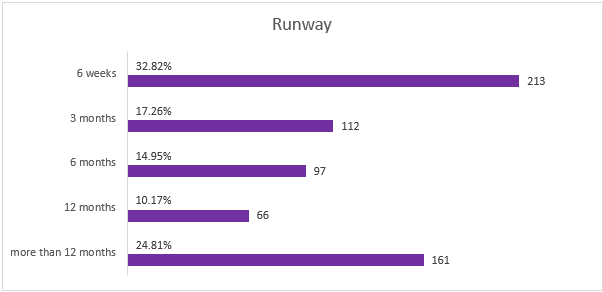

Current “Runway”

In the startup world, the term “runway” means the amount of time until a startup runs out of cash (assuming current income and expenses remain constant). It is calculated by dividing the current cash position by the current “burn rate” to determine the remaining time left before insolvency. Among those who took our investor readiness test, approximately one third of respondents disclosed that they had less than six weeks “runway”. And approximately 18% and 15% of respondents have less than three months or six months runway, respectively.

Raising capital from third parties is almost always difficult, especially at the pre-seed stage. If an entrepreneur does not have a prior track record orchestrating a successful exit or two, and a close network of qualified investors ready and eager to fund new deals, raising capital can be especially hard and extremely time consuming. A general rule of thumb is that it takes at least three to six months to successfully close a financing round. In light of that, the alarm bells should be ringing loudly among at least 65% of our respondents: unless these respondents increase income, reduce expenses or raise capital, they will become insolvent in less than six months.

For post-seed stage ventures, other industry studies among VC-backed companies have shown that the median time between funding rounds is approximately 22 months from Seed to Series A; 24 months from Series A to Series B, and 27 months from Series B to Series C. Accordingly, even though more than one fourth of respondents in our study believe they have enough cash to fund operations at current levels for more than a year, they should not allow themselves to become complacent as it would be wise to plan to raise at least two years runway (while still hitting milestones) in order to maximize the probably of getting additional funding at a later stage.

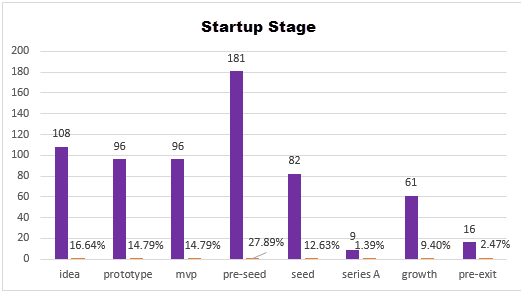

Stage of Development

Our study attracted respondents in many different stages, from idea to pre-exit, as illustrated in the chart above. 17% of respondents are still in the very earliest stage of the innovation + entrepreneurship journey: “All I have is a big idea.” 15% of respondents have taken the next step by developing their big idea into a prototype, but not yet organized an entity. 15% of respondents have registered/organized an entity, but still don’t have a Minimum Viable Product or Service. 28% of respondents have an MVP, but are still in the pre-revenue or pre-seed stage (bootstrapping). 13% of respondents have raised seed capital and/or achieved product/market fit. 1.4% of respondents have closed a Series A round. 9.5% are in growth mode and need growth capital (Series B and beyond). 2.5% of respondents are preparing their company for exit via a strategic sale or public listing.

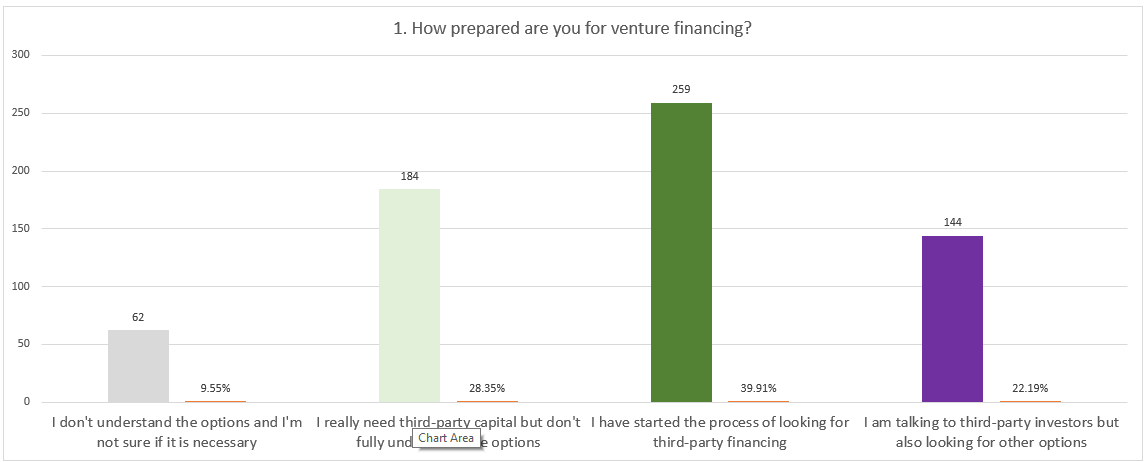

State of Venture Finance Knowledge and Preparedness

According to the data, the self-perception of venture finance knowledge and preparedness differs widely among our respondents. In our study, 62% of respondents claim they are already in venture finance “game mode”, with 40% of respondents disclosing that they have started the process of searching for 3rd party financing, and 22% of respondents disclosing that they are currently talking to third party investors, but also looking for other options. On the other side, 28% of respondents report that they really need third party capital but do not fully understand their options, and 10% of respondents say they do not understand what their venture finance options are or whether it is necessary. This research reveals that 38% of respondents in our study acknowledge that they lack fundamental and foundational knowledge about one of the critical levers to facilitate innovation and entrepreneurship, what we call Venture Finance 101.

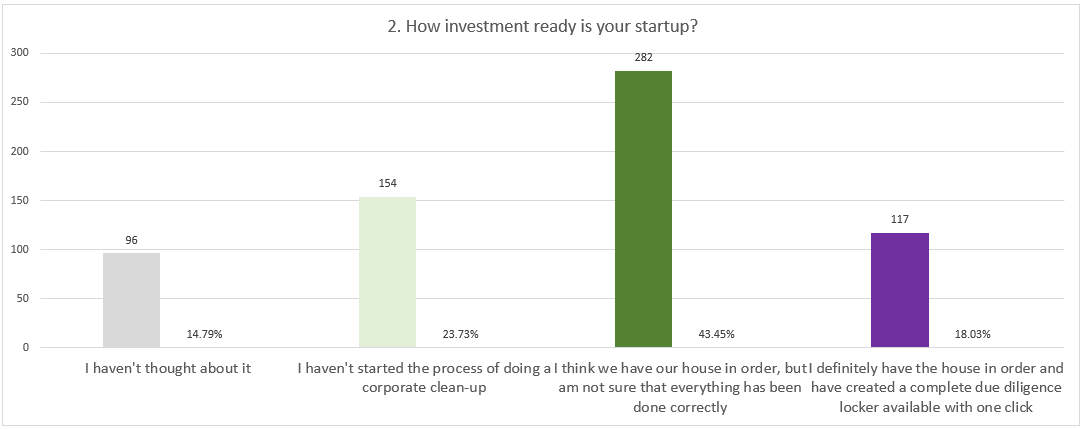

State of “House in Order”

Innovation and entrepreneurship can be a bit messy, especially during the early stages. In our study, only 18% of respondents reported that they definitely have their house in order with a complete due diligence locker available to prospective investors in one click. 43% of our respondents are feeling pretty good about whether they have their house in order, but not sure everything has been done correctly. 24% of respondents have not started the process of doing a corporate cleanup, and 15% haven’t even thought about this subject. Although we have not yet drilled down further into the data, one would expect that there would be large overlap between the 40% of respondents that have not started or thought about a corporate cleanup, and the 33% of respondents who indicated that they are still in either the idea stage or pre-incorporation stage. Conversely, we wonder if there is any overlap between the 39% of respondents that have not started or thought about a corporate cleanup, and any of the respondents who reported raising at the seed stage or beyond. This is an area ripe for further research and study by us.

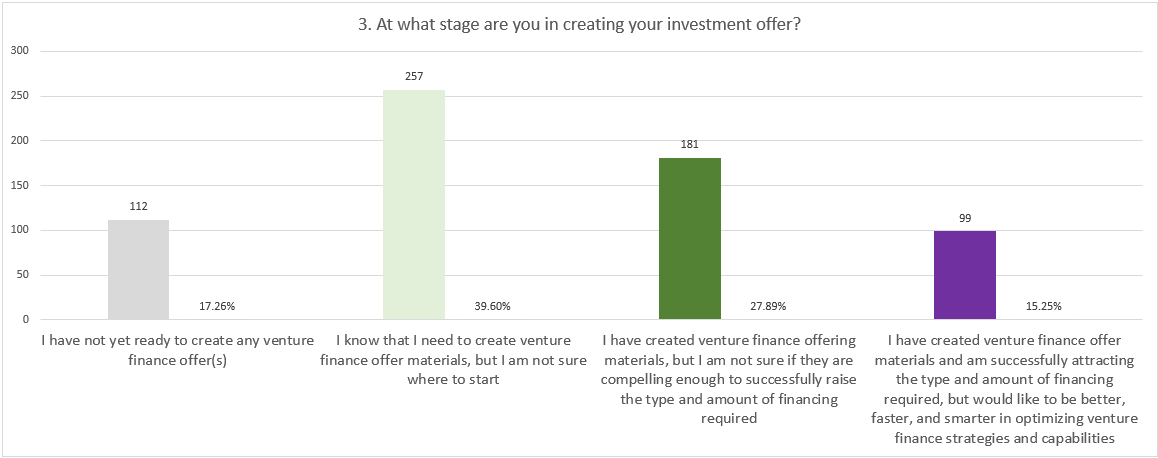

State of Venture Finance Offering Materials

Successfully raising capital from third party sources requires not just time and energy, but also skilled offering materials design, marketing and sales savvy, and professional services (especially corporate and securities law capabilities). In our study, 15% of respondents reported that they have created venture finance materials and are successfully attracting the type and amount of financing required. Not surprisingly, of those who are having success already, they would also like to be better, faster and smarter in optimizing venture finance strategies and capabilities. 28% of respondents have created some form of venture finance materials, but they are unsure if they are compelling enough to successfully raise the type and amount of financing required. 40% of respondents know that they need to create venture finance offer materials, but are not sure where to start. Finally, 17% of respondents are not yet ready to create any venture finance materials. In our study, it is interesting to contrast the number of respondents (62%) that say that are in venture finance “game mode” (i.e, currently talking to third party investors, or in the process of searching for third party investors), with the 43% of respondents who say they have actually created some form of venture finance materials. That would suggest that almost one fifth of respondents in our study are trying to raise financing from third parties without having any form of venture finance offering materials. In our experience, that is a losing strategy. Further, that data illustrates, once again, that far too many founders and entrepreneurs lack fundamental and foundation knowledge about how to get access to sources of capital that may be required to help nurture, develop, launch, finance and grow innovative ideas and business ventures.

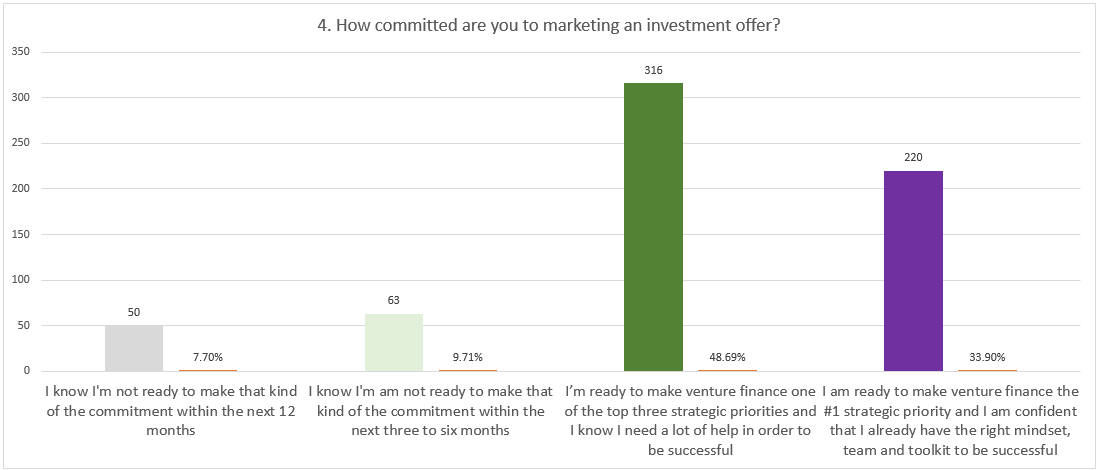

State of Mind - Mindset and Commitment

Perhaps it is not surprising that there is a strong correlation between individuals who are willing to take our Investor Readiness Test and individuals inclined to make venture finance a top strategic priority. In our study, 34% of respondents state that they are ready to make venture finance their #1 strategic priority, and they are confident they have the right mindset, team and toolkit to be successful. Another 49% of respondents state they are ready to make venture finance one of the top three strategic priorities, but acknowledge that they know they need a lot of help in order to be successful. On the other hand, in our study, only 17% of respondents state that they are not ready to make that kind of commitment within either the next three to six months (8%) or even the next twelve months (9%).

Conclusion

Notwithstanding the global pandemic and other movements and challenges around the world in the year 2020 that are disrupting old ways of working, communicating and thinking, there is no shortage of visionary, ambitious and passionate men and women willing to invest time, reputation and relationships to turn big ideas into a reality. Our research during the summer of 2020 with 649 individuals from 55 countries who self-identify as a startup founder or business owner reveals a number of things, including:

- 65% of startup founders in our study have less than six months runway, and will become insolvent unless they increase income, reduce expenses or raise capital from third parties;

- 26% of of startup founders in our study have raised seed capital and/or achieved product/market fit, Series A, or in growth mode (Series B and beyond), and 2.5% are preparing their company for exit via strategic sale or public listing;

- 38% of startup founders in our study acknowledge they lack fundamental and foundational knowledge about the subject venture finance;

- 39% of of startup founders in our study have not started or thought about what they need to do, organizationally, to get their “house in order”;

- only 15% of startup founders in our study are successfully attracting the type and amount of financing they require;

- 83% of of startup founders in our study are willing to make venture finance one of their top three current strategic priorities, but only 34% are willing to make it their #1 current strategic priority.

Are you currently raising money for your startup?

But... are you, your team and startup ready to take it?

If you are a startup founder and would like to take the Investor Readiness Test Click on the button below.